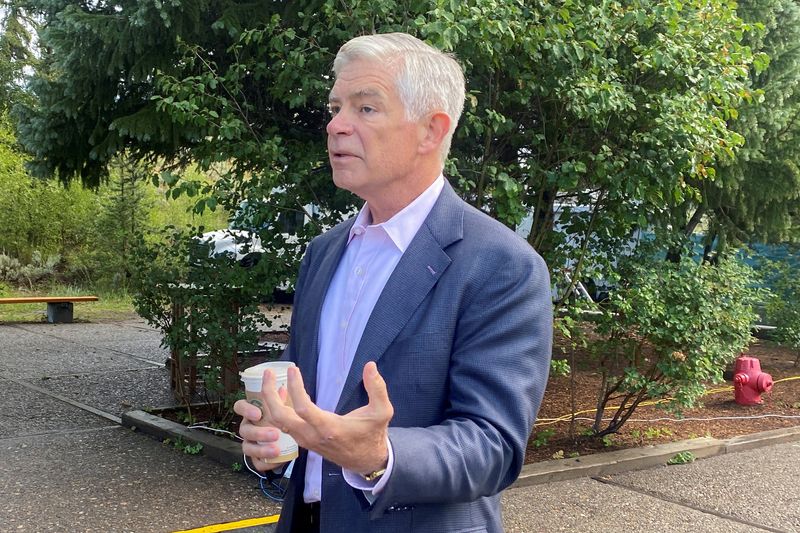

(Reuters) - The Federal Reserve has not yet finished its round of interest rate hikes to reduce inflation and will have to raise them above 5% but the peak is likely near, Philadelphia Fed President Patrick Harker said on Tuesday.

"In my view, we are not done yet … but we are likely close," Harker said in prepared remarks at an event in Philadelphia. "At some point this year, I expect that the policy rate will be restrictive enough that we will hold rates in place and let monetary policy do its work."

Harker previously said in a Reuters interview last week that moving to 25-basis point interest rate rises was a good strategy for the U.S. central bank, as he flagged the prospect of rate cuts in 2024 should inflation continue to ease.

The Fed's benchmark overnight lending rate is currently in the 4.50%-4.75% range. Harker also repeated his assertion that the policy rate would have to rise above 5% but how far beyond that would be determined by incoming data.

"How much above 5%? It's going to depend a lot on what we are seeing... today we had an inflation report that was good in that it is moving down, but not quickly," Harker said, referring to a key U.S. government report earlier on Tuesday which showed consumer prices on a monthly basis accelerated in January, though the annual increase continued to slowly abate.

Other Fed officials on Tuesday said they were keeping an open mind on how high interest rates will need to go to tame inflation which, by the Fed's preferred measure, is still running at a 5.0% annual rate.

Harker added that he does not see a recession on the horizon. Instead he pointed to the strength of the labor market as indicative that the central bank can bring inflation back to its 2% goal without a sharp spike in layoffs.

"I do think we will see a very slight uptick in unemployment, probably topping out modestly above 4 percent this year. It's an underrated advantage that the Federal Reserve is taking on inflation from a position of such labor market strength," Harker said.