By Kevin Yao

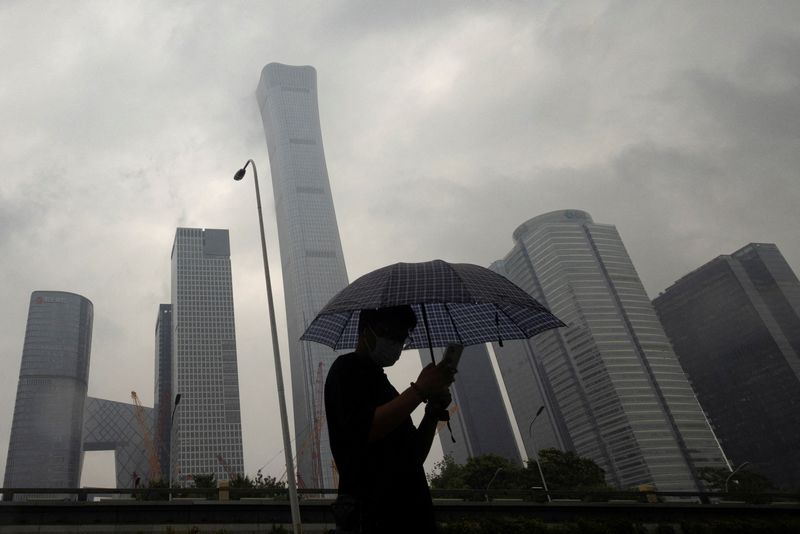

BEIJING (Reuters) - China's economy likely slowed in the third quarter, data is expected to show on Wednesday, weighed by persistently weak demand, although increased stimulus has improved the prospects Beijing might be able to hit its full-year growth target.

The world's second-largest economy faltered in the second quarter after a brief post-COVID recovery, dragged by a property downturn and huge debt due to a decades-long infrastructure binge.

The government has in recent weeks unveiled a raft of measures, including more public works spending, interest rate cuts, property easing and efforts to shore up the private sector.

Gross domestic product (GDP) likely grew 4.4% in July-September from a year earlier, according to economists polled by Reuters, slowing from the 6.3% pace in the second quarter.

GDP data is due on Wednesday at 0200 GMT. Separate data on September activity is expected to show retail sales growth picking up but factory output slowing.

While recent economic data has shown some signs of stabilising after a flurry of modest support measures, economists believe more is needed to shore up activity.

Growth is forecast to pick up to 4.9% in the fourth quarter.

China's exports and imports have continued to decline, although at a slower pace. And while bank lending has jumped, persistent deflationary pressures underline the challenges policymakers face in trying to revive activity.

Economists remain concerned about the crisis-hit property sector, employment and household income and weak confidence among some private firms.

"Beijing may have also shifted to wait-and-see mode, as it assesses the impact of stimulus measures rolled out in the past few months," said Ting Lu, chief China economist at Nomura, in a note.

"We expect a triple dip towards year-end or early 2024, and Beijing may have to step up its efforts to stabilise growth again at that time."

On a quarterly basis, GDP is forecast to grow 1.0% in the third quarter, a slight pickup from 0.8% growth in April-June.

Economic growth is seen hitting 5.0% this year, according to the poll, broadly in line Beijing's full-year target, before slowing to 4.5% in 2024.

The economy grew just 3% last year due to COVID curbs, badly missing the government's official target.

Economists polled by Reuters expect the central bank to keep banks' reserve requirement ratio (RRR) - the amount of cash that banks must hold as reserves - and benchmark lending rates steady for the rest of the year.

Beijing may also step up fiscal stimulus to get activity on a more solid footing, though analysts believe the benefits may not be seen until well into 2024.

For its part, the central bank is constrained by how much it can ease monetary policy due to worries about adding pressure on the yuan, which has tumbled 5.7% this year.

The central bank cut the RRR in September to boost liquidity and support the economic recovery, its second reduction this year.