BEIJING (Reuters) - China needs to step up measures as soon as possible to bolster a faltering post-COVID recovery in the world's second-largest economy, a senior economic official with the country's top political advisory body said on Sunday.

Analysts at major international banks have downgraded economic growth forecasts for 2023 after May data showed demand weakened in China and abroad, raising the case for more stimulus.

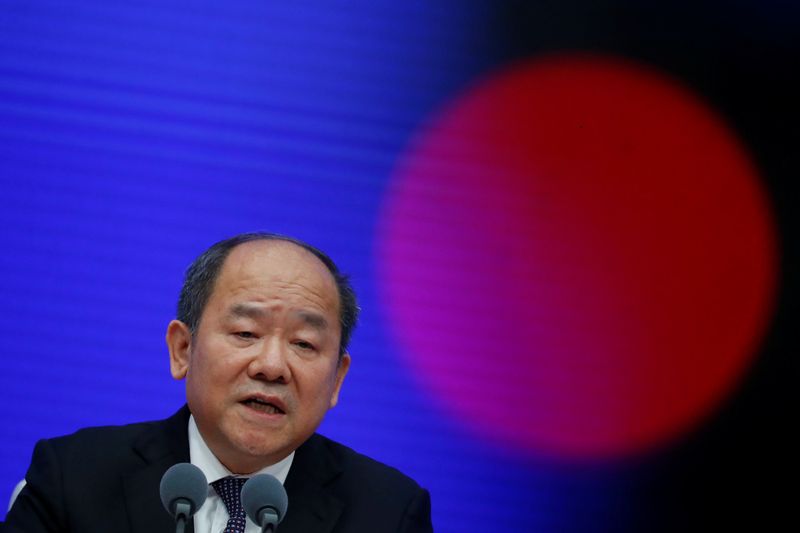

"It is better to introduce measures sooner (rather) than later," said Ning Jizhe, deputy head of the economic committee of the Chinese People's Political Consultative Conference (CPPCC) and a former vice head of the National Development and Reform Commission (NDRC).

China's economy faces heavy downward pressure and its recovery is unstable and imbalanced, said Ning, who is also a former head of the National Bureau of Statistics.

The strength of macroeconomic measures "ought not be small" to prevent "an economic spiral contraction" in a global slowdown, said Ning.

China's cabinet this month met to discuss measures to boost economic growth, pledging to roll out policies in a timely manner and to take more forceful actions in response to changes in the economic situation.

The nation's benchmark loan prime rates (LPR) were cut on Tuesday in the first such reductions in 10 months while the five-year LPR was reduced by a smaller than expected 10 basis points.

China's central bank is likely to cut lending rates further, but a reluctance to borrow among private companies and households means that continued policy easing could hurt banks that are already battling margin pressures, analysts said.