By David Shepardson

WASHINGTON (Reuters) -The chair and top Democrat on the House select committee on China will announce Tuesday they are launching a bipartisan working group to reduce China's dominance of critical mineral supply chains.

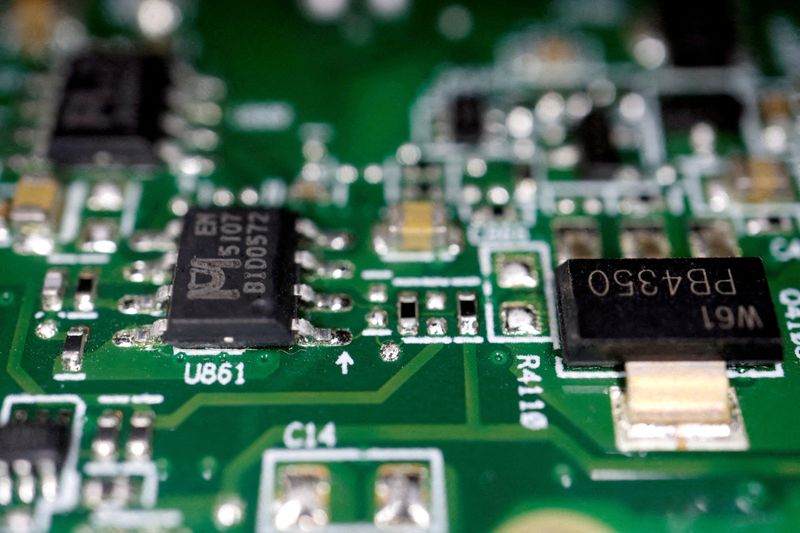

Representative John Moolenaar, the committee chair, and Raja Krishnamoorthi, the top Democrat, said the new working group will help propose policies to lower U.S. reliance on China for critical minerals used in a variety of products from semiconductors and wind turbines to electric vehicles.

The group "will work to create transparency into U.S. supply-chain dependency for critical minerals and develop a package of investments, regulatory reforms, and tax incentives to reduce that dependency," the committee said in a statement to Reuters.

The Critical Minerals Policy Working Group will be led by Republican Representative Rob Wittman and Democratic Representative Kathy Castor.

"Critical minerals are the building blocks of everything from basic consumer goods to advanced military technology. America’s reliance on the Chinese Communist Party’s control of the critical mineral supply chain would quickly become an existential vulnerability in the event of a conflict," Moolenaar said in a statement.

He noted China has already imposed export restrictions on rare earth elements such as gallium, germanium and graphite, as well as mineral-processing equipment.

Last month, the U.S. Treasury Department gave automakers additional flexibility on battery-mineral requirements for electric-vehicle tax credits on some crucial trace minerals from China, such as graphite. Congress passed legislation in 2022 aimed at weaning the U.S. EV-battery chain away from China.

New rules took effect on Jan. 1 restricting Chinese content in batteries eligible for EV tax credits of up to $7,500.

The Biden administration last month announced it plans to impose new tariffs on $18 billion in Chinese goods including electric vehicles, batteries, semiconductors, aluminum, critical minerals, solar cells, ship-to-shore cranes, and medical products. Tariffs for certain critical minerals will increase from zero to 25% later this year.