- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why You Should Buy An Overbought Stock

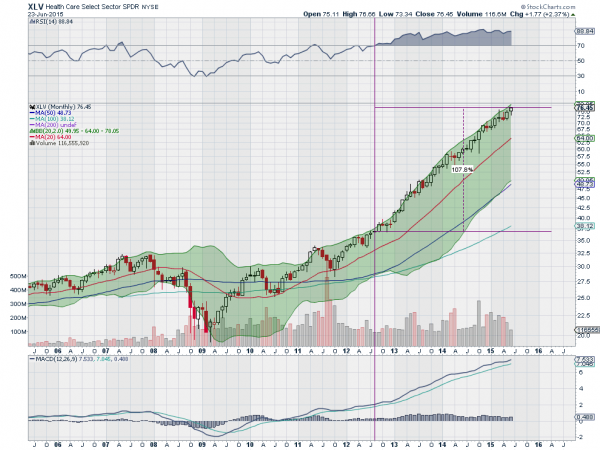

Some people think that you should not buy a stock that is overbought. The chart below of the Health Care Select SPDR (ARCA:XLV) is a good example of why that is wrong. By definition a stock becomes ‘overbought’ when the Relative Strength Index (RSI) moves over 70. The counter example, oversold, is defined as a move under 30. This is a measure of momentum and moves on a scale from 0 to 100. So it may seem reasonable that at 70 it is registering overbought. But like any measure of momentum overbought can get more overbought.

And that is surely the case for the Health Care ETF. from the time that it moved into overbought territory in August 2012 until now it has risen 107%. And it is now two candlesticks away from being overbought for 3 years. Did you miss out on 107% and 3 years of gains because it was overbought?

Perhaps there is a better way to understand and interpret the overbought condition. It may be easier if you let go of the label all together, since it is randomly selected anyway. What if instead you looked at just two things to determine if a stock is for you or not. First, is the RSI rising, falling or flat. If it is rising or flat then the momentum is increasing or holding by definition. This is not a time to avoid a stock.

Second, is the price confirming or diverging with what you see in the RSI? Price and its direction is always more important that any indicator. That is because price is all that matters to your transaction when you buy or sell. I do not like to buy stocks when they are falling. That is my rule and it is not for everyone, nor the only way to make money.

When I couple these two rules the result is buy stocks that are rising and have rising or flat but good momentum. Do not buy stocks that are falling. Look to protect stocks you own or profits when the momentum starts to fall even if the price is not.

There are more to my rules than these, but just these simple rules would have allowed you to stay in the Healthcare Sector for 3 years, as it was overbought the entire time. Would your rules let you continue to hold this?

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Related Articles

If you can keep your emotions in check, the volatility in stocks sets up a long-term buying opportunity. However, investors with a lower risk tolerance may want to consider...

Let’s get right to it. First a quick comment on the weekly charts. The Russell 2000 (IWM) (Gramps) is at a key life support level on the 200-week moving average. Grandma...

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.