- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Yen Quiet, Markets Eye Japanese Current Account

USD/JPY is almost unchanged in the Monday session. In North American trade, the pair is trading at 110.80, up 0.11% on the day. On the release front, it’s a quiet start to the week, with no US releases on the calendar. Later in the day, Japan releases Current Account, with the surplus expected to climb to JPY 1.51 trillion. On Tuesday, the US publishes releases JOLTS Jobs Openings, which is expected to edge lower to 5.66 million.

The US dollar pushed the yen lower on Friday, courtesy of a solid nonfarm payrolls report. The indicator came in at 209 thousand, easily beating the estimate of 182 thousand. The unemployment rate edged lower to 4.3%, but the positive news was dampened somewhat by wage growth, which remained unchanged at 0.3%. This underscores weak inflation levels, which has left investors skeptical as to whether the Federal Reserve will raise rates one final time in 2017.

Last week’s strong US payrolls report boosted the US dollar and raised the odds of a December rate hike, which are currently at 47%, up from 43% one week ago. With the Federal Reserve unlikely to raise rates before December, investor attention has shifted to the Fed’s balance sheet, which stands at $4.2 trillion. Fed policymakers have broadly hinted at reducing purchases of bonds and securities starting in September, but San Francisco Fed President John Williams was more forthcoming about the Fed’s plans, likely aimed at giving notice to the markets. In a speech on Wednesday, Williams said that the economy had “fully recovered” from the 2008 financial crisis and called on the Fed to start trimming the balance sheet “this fall”. Williams added that the process would be gradual and would take four years to reduce the balance sheet to a “reasonable size”. Other FOMC members have also come out in favor of the Fed starting to wind up its portfolio this fall.

Japan’s economy has shown improvement, but the Japanese consumer remains pessimistic about economic conditions. Consumer Confidence moved higher in July, with a reading of 43.8 points. This marked a 4-month high. The lack of confidence in the economy has resulted in soft borrowing and spending levels. At the same time, manufacturing and housing indicators looked sharp earlier this week. Preliminary Industrial Production rebounded with a strong gain of 1.6%, after a decline of 3.3% a month earlier. As well, Housing Starts gained 1.7%, compared to a reading of -0.3% in May. These numbers underscore a stronger Japanese economy, buoyed by stronger demand for Japanese exports. However, weak inflation levels remain a serious concern. The BoJ’s ultra-loose monetary policy has failed to coax inflation upward. At its recent policy meeting, the BoJ again extended its time-frame for reaching its inflation target of 2%. The bank is reluctant to scale back its asset-purchase program, which means that it will likely lag behind other central banks, such as the ECB, in reducing its stimulus program.

USD/JPY Fundamentals

Monday (August 7)

- 1:00 Japanese Leading Indicators. Estimate 106.2%. Actual 106.3%

- 13:25 US FOMC Member Neel Kashkari Speaks

- 15:00 US Consumer Credit. Estimate 15.6B

- 19:50 Japanese Bank Lending. Estimate 3.3%

- 19:50 Japanese Current Account. Estimate 1.51T

- 23:45 Japanese 30-y Bond Auction

Tuesday (August 8)

- 1:00 Japanese Economy Watchers Sentiment. Estimate 49.8

- 10:00 US JOLTS Job Openings. Estimate 5.66M

*All release times are GMT

*Key events are in bold

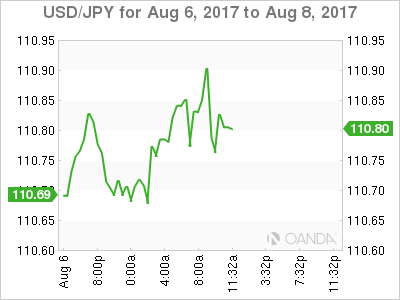

USD/JPY for Monday, August 7, 2017

USD/JPY August 7 at 11:10 EDT

Open: 110.81 High: 110.92 Low: 110.64 Close: 110.83

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.49 | 108.69 | 110.10 | 110.94 | 112.57 | 113.55 |

USD/JPY was flat in the Asian session. The pair inched higher in the European trade and is showing little movement in North American trade

- 110.10 is providing support

- 110.94 is a weak resistance line

Current range: 110.10 to 110.94

Further levels in both directions:

- Below: 110.10, 108.63 and 107.49

- Above: 110.94, 112.57, 113.55 and 114.37

OANDA’s Open Positions Ratios

In the Monday session, USD/JPY ratio is showing long positions with a majority (66%), indicative of trader bias towards USD/JPY reversing directions and moving upwards.

Related Articles

The dollar’s rebound faces a key test as traders assess Fed expectations, geopolitics, and slowing spending. With inflation cooling and rate-cut bets rising, markets eye jobs...

Eurozone inflation may have exceeded expectations, but it has slowed from the previous month. This allows the European Central Bank (ECB) to consider cutting its key interest rate...

USD/JPY defended key support at 148.65, bouncing into month-end Yield spreads collapsed, but the yen failed to capitalise Markets now fully price two Fed cuts in 2025, with a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.