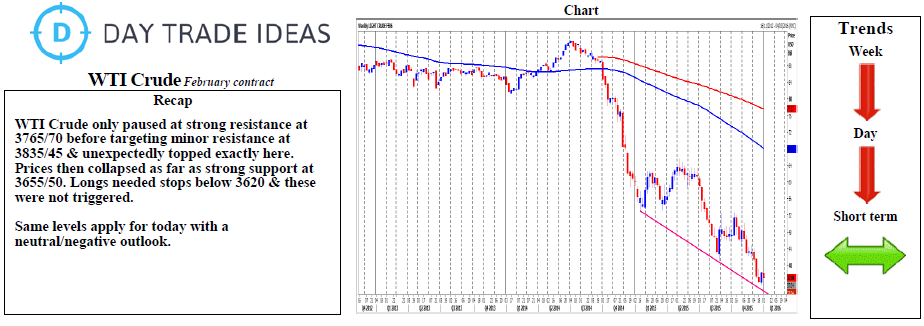

WTI Crude first resistance at 3715/20 but above here stronger resistance at 3765/70 should act as the main challenge for bulls today. Shorts need stops above 3800. A break higher targets minor resistance at 3835/45 but if we beat this level today look for a selling opportunity at 3895/3900. A good chance of a high for the day if we reach this far but shorts need stops above 3935. Just be aware that a break higher could target 4000/4010.

Holding below 3720/15 retests quite strong support at 3655/50. Longs need stops below 3620. The outlook is fairly negative so further losses could target 3566 before the February contract low for the bear trend at 3535. A break lower is obviously negative and targets 3510/05. If we continue lower look for 3465/60 then important trend line support at 3405/00.