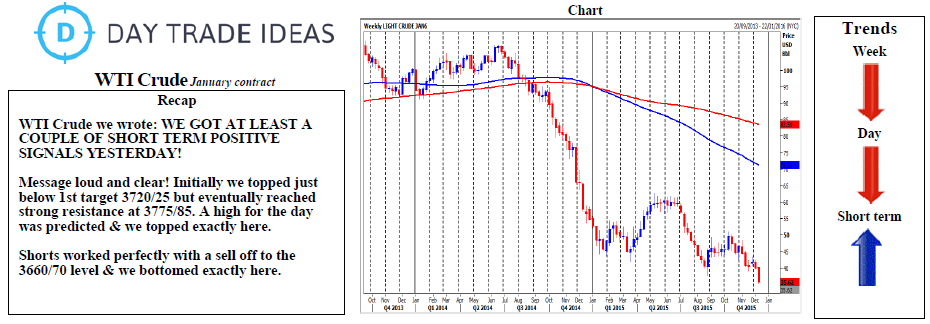

WTI crude must hold first support at 3660/70 if we are to build on gains and re-target 3720/25, then strong resistance at 3775/85. A good chance of a high for the day yet again however as we become overbought short term. Shorts need stops above 3815. Be ready to buy a break above 3800 for an added buy signal to target 3830/35, then important trend line resistance at 3890/3900. Further gains unlikely but be aware a break targets an excellent selling opportunity at 3980/90.

Failure to hold first support at 3660/70 targets 3605/00 then 3575/70. If we continue lower, look for 3520/15 then support at 3465/60. A break below 3450 is a sell signal however and targets 3413. Failure here targets 3355 then 3320. If we continue lower this week, we could be retesting 2009 year lows at 3270. The low for 2008 is not far below at 3240, so clearly this 30 tick band is mega important.