- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

With A Bull Market Like This, You Don’t Need A Bear Market

Despite the beating that many momentum leaders took on Monday, the major indexes are still hovering near all-time highs.They say that bull markets correct through sector rotation. This has certainly been the case this year:

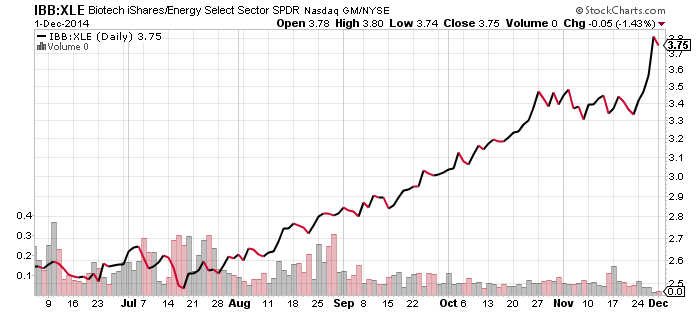

Over the past quarter, we had 65 stocks that went down >50% (mostly energy names) and 22 that went up >50% (mostly biotech). This is an almost 3:1 ratio. Then, it should not be a big surprise that the iShares NASDAQ Biotech (NASDAQ:IBB)/SPDR Energy Select Sector Fund (ARCA:XLE) ratio is up 50% since August.

For the past 6 months, we have 227 liquid stocks down 30% or more vs 246 up 30% or more. For the same period, the S&P 500 is up 7% without counting its dividends. This is what a call a low-correlation market of stocks.

2014 has been the year of large caps

After gaining 37% in 2013, the Nasdaq 100 (PowerShares QQQ (NASDAQ:QQQ)) is up another 20% YTD.

173 of the S & P 500 stocks are up more than 20% YTD. This is more than 1/3.

In the same time, Russell 2000 (iShares Russell 2000 Index (ARCA:IWM)), which represents small caps, is down for the year.

Typically, large caps start to outperform in the late stages of a bull market.

2014 Has Been the Year of Biotech, Semi-conductors and Cheap Oil

We have 155 stocks that are up more than 50% YTD. More than 1/3 of them (61) are biotech, drug manufacturers and medical supplies stocks. There are 18 semi-conductors. There are 8 airlines, 3 restaurants and 3 truck stocks belonging to the group.

115 stocks are down more than 50% YTD.

For the statistics I used stocks, currently priced above 3 and trading over 200k shares a day, which is an universe of 2500 names.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.