- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Zumiez (ZUMZ) Retain Positive Earnings Trend In Q4?

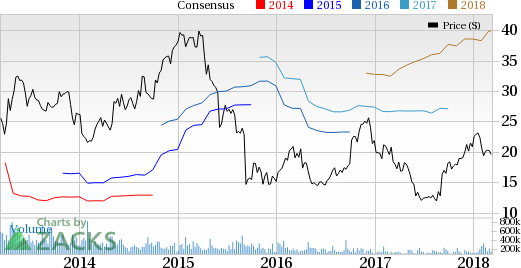

Zumiez Inc. (NASDAQ:ZUMZ) is slated to release fourth-quarter fiscal 2017 results on Mar 15. Last quarter, the company delivered earnings in line with the Zacks Consensus Estimate.

In fact, the company surpassed estimates in the trailing four quarters with an average beat of 22.2%.

What to Expect?

The question lingering in investors’ minds now is whether Zumiez will be able to deliver a positive earnings surprise in the quarter to be reported. The Zacks Consensus Estimate for the quarter under review is 90 cents per share, reflecting 21.6% growth from the year-ago quarter. We note that the Zacks Consensus Estimate for the quarter has been stable in the last 30 days. Analysts polled by Zacks anticipate revenues of $301.8 million, up 14.5% from the year-ago quarter.

Moreover, we note that the company’s shares have outperformed the industry in the past month. The stock has inched up 1.9%, while the industry has dipped 0.6%.

Factors at Play

A mall-based specialty retailer of action sports-related products, Zumiez has been riding on robust top and bottom-line surprise trends alongside solid comps performance in recent months. Though the company’s earnings matched estimates in third-quarter fiscal 2017, it has delivered a positive earnings surprise in the preceding eight quarters. Moreover, sales topped estimates for the sixth straight quarter. Additionally, it has reported positive comps in the last five quarters.

Zumiez’s favorable comps trend continued in January 2018 having delivered 6.3% growth in the metric for the month. Moreover, sales surged 33.6% to $66 million. Excluding the 53rd week, sales rose 12.8%.

Backed by higher-than-anticipated sales in January, the company now expects earnings per share for fourth-quarter fiscal 2017 at the higher end of its previously guided range of 88-90 cents.

Additionally, Zumiez has been gaining from its efforts to keep pace with the evolving retail trends, evident from its focus on omni-channel development. Its strategic initiatives, authentic lifestyle positioning and commitment to enhancing customer service place it well for market-share gains.

What the Zacks Model Unveils

Our proven model does not conclusively show that Zumiez is likely to beat estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zumiez has an Earnings ESP of 0.00% and a Zacks Rank #3. Although the Zacks Rank #3 increases the predictive power of ESP, an ESP of 0.00% makes surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to beat on earnings this time around:

DICK’S Sporting Goods Corp. (NYSE:DKS) has an Earnings ESP of +2.95% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Children’s Place Inc. (NASDAQ:PLCE) has an Earnings ESP of +0.40% and a Zacks Rank #2.

Dollar General Corp. (NYSE:DG) has an Earnings ESP of +1.69% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.