- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Ulta Beauty's (ULTA) Positive Comps Aid Q4 Earnings?

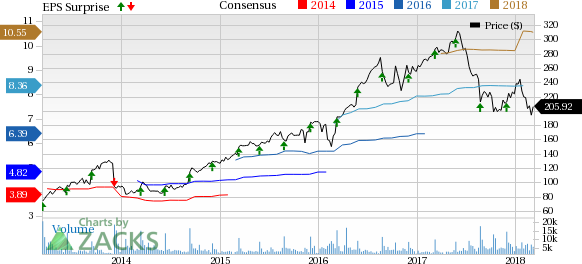

Ulta Beauty, Inc. (NASDAQ:ULTA) is slated to announce fourth-quarter fiscal 2017 earnings on Mar 15. In the preceding quarter, it came up with a positive earnings surprise of 1.8%.

In the trailing four quarters, the company’s earnings outperformed the Zacks Consensus Estimate by an average of 4.1%. In fact, it delivered an earnings beat for 16 straight quarters. Let’s see how things are shaping up for this announcement.

What to Expect?

Investors are keen on finding out whether Ulta Beauty will be able to continue with its positive earnings surprise streak in the to-be-reported period. The Zacks Consensus Estimate for fourth-quarter 2017 is pegged at $2.77 per share, reflecting year-over-year growth of 23.7%. However, the consensus mark has been witnessing a downtrend in the last 30 days. Further, analysts polled by Zacks expect revenues of $1.94 billion, representing a 22.6% increase from the year-ago quarter.

Nonetheless, we note that shares of the company have underperformed the industry in the past six months. The stock has declined 9%, wider than the industry’s decrease of 0.9%.

Factors at Play

Ulta Beauty has been gaining from its effective marketing initiatives, loyalty program, sturdy e-commerce business, superb salon operations as well as strength in prestige cosmetics. Additionally, a favorable traffic is driving comparable store sales (comps) growth. Its notable growth in e-commerce sales has also helped it stand out amid intense online competition.

Furthermore, Ulta Beauty has maintained a solid earnings surprise trend, having reported 16 straight quarters of earnings beat. The company’s top line has also surpassed estimates in 15 of the last 16 quarters. Robust top and bottom-line performances can be attributed to enhanced market share gains and benefits from attractive loyalty program offers. Additionally, the company is witnessing sturdy growth across all product categories with prestige cosmetics standing out.

Looking ahead, the company expects comps growth (including e-commerce) in the 10-11% range for fiscal 2017. Meanwhile, it anticipates e-commerce sales growth of 50-60%. Earnings per share are envisioned to rise in the band of high 20s’ percentage.

However, declining margins and stiff competition remain impediments. Ulta Beauty witnessed contraction of both gross and operating margins in the fiscal third quarter. Also, the company is exposed to risk in the customer-driven industry as cheaper alternatives might hinder buyers’ loyalty for the brand, thereby impacting the sale of products under Ulta banner.

What the Zacks Model Unveils

Our proven model does not conclusively show that Ulta Beauty is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Ulta Beauty has an Earnings ESP of -1.38% and a Zacks Rank #2. While the company’s Zacks Rank #2 increases the predictive power of ESP, we need to have a positive ESP to be confident about an earnings surprise.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to beat on earnings this time around:

DICK’S Sporting Goods Corp. (NYSE:DKS) has an Earnings ESP of +2.95% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Children’s Place Inc. (NASDAQ:PLCE) has an Earnings ESP of +0.40% and a Zacks Rank #2.

Dollar General Corp. (NYSE:DG) has an Earnings ESP of +1.69% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS): Free Stock Analysis Report

Ulta Beauty Inc. (ULTA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.