The Federal Reserve is widely expected to announce later today that it will begin winding down its $85-billion-a-month bond-buying program. Not surprisingly, there’s a wide range of opinion on the wisdom, or the lack thereof, of this anticipated change in policy. On one extreme is the view that it’s too early to begin tapering monetary stimulus because economic growth remains fragile, particularly on the employment front. At the opposite spectrum is the hawkish view that embracing monetary rectitude is long past due in order to keep inflationary pressures in check after five years of extraordinary stimulus. This much is clear, however: inflation expectations remain relatively stable and low and the macro outlook is improving these days, which lays the groundwork for thinking that the Fed may be inclined to reverse course on the margins.

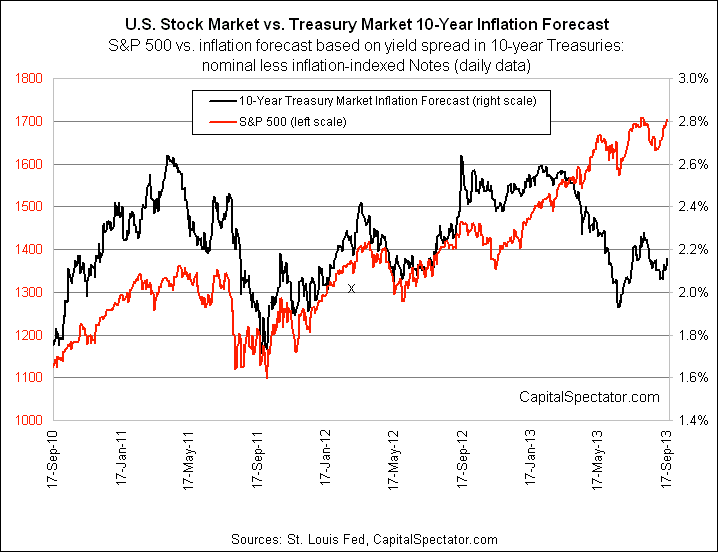

As you can see in the chart below, the market’s forecast for inflation (as implied by the yield spread for the nominal 10-year Note less its inflation-indexed counterpart) has remained in the 2.0%-to-2.2% range in recent months. Looking back over the last two years or so, a wider 1.8%-to-2.6% range has prevailed. The key point is that there’s been no trend per se. The stock market, meanwhile, has continued to rise. The main takeaway: expectations for growth have improved while inflation expectations have remained contained in a fairly low range. Based on these two variables, the case for tapering is stronger, at least in relative terms.

The main argument against tapering is the still-moderate rebound in the labor market. Although nonfarm payrolls have been consistently growing for several years, the depth and quality of the jobs being generated still leaves many unemployed and under-employed workers without good choices, if any. Business cycle risk may be low, but that’s of little relevance if you’re still looking for work or stuck in a position that’s far below your career and educational qualifications.

Today’s Fed announcement, in other words, will be analyzed from the perspective of how the central bank views the labor market’s prospects. Keep an eye on today’s quarterly update of economic projections. For example, in the June release the Fed lowered its central tendency 2014 forecast for unemployment to a 6.5%-to-6.8% range, down slightly from March’s 6.7%-to-7.0% prediction for next year. Presumably, this range will tick down again if the Fed begins to taper.