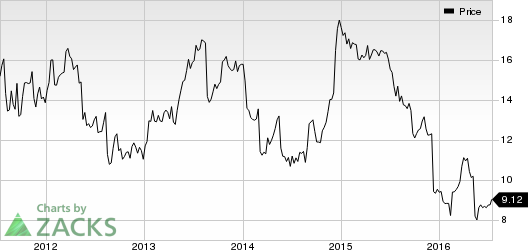

Staples, Inc. (NASDAQ:SPLS) , whose share price has declined more than 40% in the past one-year period primarily due to merger-related issue, is looking to bounce back with new strategic initiatives. After the U.S. District Court ruled out the merger with Office Depot, Inc. (NASDAQ:ODP) , Staples has outlined certain plans to increase long-term value. These initiatives have driven the company’s share up by 4.7% in the past one month. Let’s delve deeper.

Staples intends to increase its product offerings as well as services beyond office supplies, in order to acquire new customers. It plans to improve its supply chain capabilities through the addition of more than 1,000 associates to its mid-market sales team.

Since 2011, Staples has closed more than 300 stores in North America and is planning to close at least 50 more in 2016. The company not only intends to increase productivity but also hopes to preserve profitability in North America by expanding its services, enhancing customer base, shutting down underperforming stores and decreasing fixed costs.

This Zacks Rank #3 (Hold) company plans to initiate a new cost-saving program to garner nearly $300 million of pre-tax cost savings annually by the end of 2018.

In a bid to attract more customers, Staples has started a new service called “Staples Rush.” This service gives customers an opportunity to receive products on the same day the order is placed. This service is currently available in major metropolitan cities such as Dallas, Boston and New York, from Monday to Friday, for orders placed by 3 p.m.

Customers who place their order within the stipulated time frame will have their products delivered by 7 p.m. However, it will soon be available in other cities like Chicago, Los Angeles, Seattle and Houston San Francisco as well. We believe that the “Staples Rush” service will certainly help the company attract more customers and be competitive in the current market scenario.

Other Stocks to Consider

Better-ranked stocks worth considering in the retail sector include Five Below, Inc. (NASDAQ:FIVE) and ULTA Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA) . Both these stocks hold a Zacks Rank #2 (Buy).

OFFICE DEPOT (ODP): Free Stock Analysis Report

STAPLES INC (SPLS): Free Stock Analysis Report

ULTA SALON COSM (ULTA): Free Stock Analysis Report

FIVE BELOW INC (FIVE): Free Stock Analysis Report

Original post

Zacks Investment Research