- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Soft Comps Hurt Noodles & Company (NDLS) In Q4 Earnings?

Noodles & Company (NASDAQ:NDLS) is scheduled to report fourth-quarter 2017 numbers on Mar 14, after market close.

The company has been bearing the brunt of soft consumer demand and declining comps for quite some time now. The challenging restaurant environment in expected to have affected the company’s fourth-quarter traffic and comps as well. Also, this fast-casual restaurant chain’s margins are expected to have been under pressure due to higher costs as well as expenses related to the implementation of strategic initiatives.

However, various sales building initiatives such as streamlining of menu and its innovation, introduction of new cooking procedures, effective marketing strategy, increased focus on the off-premise business, along with investments in technology-driven initiatives like digital ordering remain encouraging.

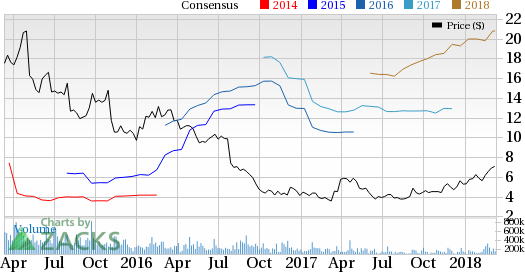

Notably, shares of Noodles & Company have rallied 95.8% in the past year outperforming the industry’s gain of 15.1%.

Let’s take a look at how the company’s fourth quarter will shape up.

Revenues Likely to Remain Under Pressure

The grim sales scenario in the U.S. restaurant space is affecting Noodles & Company’s revenues of late. In the first nine months of 2017, the company’s net revenues decreased 4% year over year due to closing down of units and declining comps. The negative trend is expected to have continued in the fourth quarter as well. The Zacks Consensus Estimate for the quarter’s net revenues is pegged at $111 million, suggesting a 14.2% year-over-year decline.

Decreased demand and subsequent closing down of restaurants have widely affected the company’s comps. In the first nine months of 2017, system-wide comps declined 3%. Keeping with the negative trend in comps, the consensus estimate for fourth quarter system-wide comparable sales suggests a 2.8% fall.

Also, the consensus estimate projects company-owned and franchised comps to decline 3% and 1.3%, respectively, in the fourth quarter. Notably, in the first nine months of 2017, company-owned comparable sales fell 3.4% and franchise comps were down 0.3%.

Bottom Line Likely to Benefit From the Closure of Underperforming Restaurants

Noodles & Company has been undertaking the task of closing underperforming restaurants that had been consistently hampering its human and financial capital. We believe that the company’s margins are likely to gain from such a move.

Subsequently, the consensus estimate predicts the loss of a penny in the fourth quarter, comparing much favorably with a loss of 4 cents incurred in the year-ago quarter.

Our Quantitative Model Does Not Predict a Beat

Noodles & Company does not have the right combination of two main ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

Zacks ESP: The company has an Earnings ESP of 0.0%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The restaurant has a Zacks Rank #3.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Noodles & Company Price and EPS Surprise

Stocks to Consider

Here are a few restaurant stocks, which according to our model possess the right combination of elements to post an earnings beat.

Darden (NYSE:DRI) has an Earnings ESP of +0.87% and a Zacks Rank #2 (Buy). The company is expected to report quarterly numbers on Mar 22, 2018. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Brinker (NYSE:EAT) has an Earnings ESP of +1.92% and a Zacks Rank #3. The company is anticipated to report quarterly figures on Apr 24, 2018.

Cheesecake Factory (NASDAQ:CAKE) has an Earnings ESP of +0.23% and a Zacks Rank #3. The company is expected to report quarterly numbers on May 2, 2018.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

The Cheesecake Factory Incorporated (CAKE): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Brinker International, Inc. (EAT): Free Stock Analysis Report

Noodles & Company (NDLS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.