- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Owens Corning's Strategic Efforts Combat Top-Line Woes?

Owens Corning’s (NYSE:OC) business is poised to benefit from strategic initiatives, acquisitions and strong price realization. Also, its strong demand for insulating products is commendable.

The company reported better-than-expected results in fourth-quarter 2019. However, the top and bottom lines declined 1.9% and 18.1%, respectively, on a year-over-year basis. The downside was mainly due to pricing headwinds, and modest declines in technical insulation in Europe and the U.S. shingle market.

Also, two one-time charges — $12-million non-cash income tax charge and green bond — and tendered portions of its 2022 and 2036 bonds weighed on margins.

Let’s delve deeper into factors that are influencing the overall performance of the company, which shares space with Foundation Building Materials, Inc (NYSE:FBM) , Gibraltar Industries, Inc (NYSE:OC) and Installed Building Products, Inc (NYSE:IBP) in the Zacks Building Products - Miscellaneous industry.

Strategies to Drive Performance

Owens Corning has been benefiting from strategic initiatives and acquisitions. In the Insulation business, the company has been expanding the geographic and product portfolio through acquisitions. Also, it is improving manufacturing efficiencies and reducing costs with investments in process technology.

In the Composites business, its efforts on higher value applications for glass non-wovens and specific markets like India are gaining traction. In the Roofing unit, it is leveraging vertical integration, material science capabilities, and commercial strength to design as well as market unique roofing shingles and components that attract contractors, homeowners and distributors.

Additionally, the company implemented pricing actions that aided the Roofing and Insulation business in 2019. Moreover, strengthening housing market fundamentals are aiding the company. The company is experiencing strong demand for insulating products. Notably, the company anticipates favorable market conditions in the U.S. new residential construction, and modest growth in global construction and industrial markets.

Owens Corning is under priced in terms of valuation. Currently, its trailing 12-month price to earnings ratio is 9.52, which is lower than the industry’s 13.41. This implies that the stock is cheaper than its peers. VGM Score helps to identify stocks that have the most attractive value, growth and momentum characteristics. The company has a VGM Score of A, indicating that the stock is most likely to outperform in the near future.

Hurdles to Cross

Lower sales volumes, primarily in the North American residential fiberglass insulation business, and negative foreign currency translation are ailing the company’s business. Particularly, lower sales volumes in the technical and other building Insulation business in Europe, as well as reduced shingle volumes in the Roofing unit affected fourth-quarter 2019 results. The company expects the U.S. shingle industry shipments to be relatively flat year over year in 2020. Also, it projects the glass fiber market to be weak in first-half 2020.

During 2019, the company’s adjusted earnings declined 8.1% from 2018 due to two one-time charges. In first-quarter 2019, it witnessed a $12-million non-cash income tax charge related to 2017 U.S. corporate tax reform.

Additionally, in third-quarter 2019, the company issued a green bond, and tendered portions of its 2022 and 2036 bonds. Alongside, it incurred a $32-million loss on extinguishment of debt during the year.

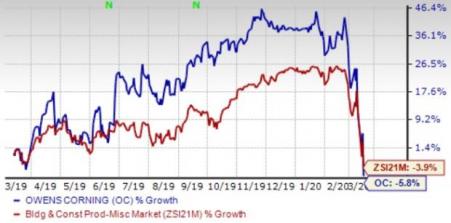

Shares of this Zacks Rank #3 (Hold) company have declined 5.8% in the past year compared with the industry’s 3.9% fall. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Owens Corning Inc (OC): Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK): Free Stock Analysis Report

Installed Building Products, Inc. (IBP): Free Stock Analysis Report

Foundation Building Materials, Inc. (FBM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.