- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will New Cloud Products Help Box (BOX) Beat On Q3 Earnings?

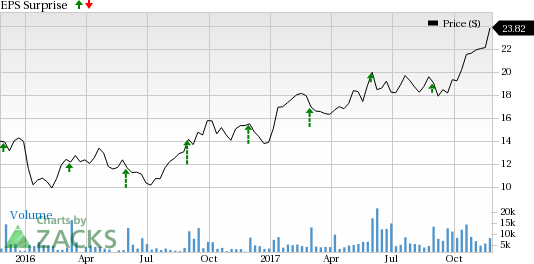

Box, Inc. (NYSE:BOX) is set to report third-quarter fiscal 2018 results on Nov 29. Last quarter, the company delivered a positive earnings surprise of 15.4%.

The surprise history has been strong in Box’s case. The company surpassed estimates in each of the trailing four quarters, with an average four-quarter positive surprise of 17.98%.

The company's shares have increased 69.7% year to date, outperforming the industry’s gain of 36.2%.

Let’s see how things are shaping up for this announcement.

Factors at Play

Box’s fiscal second-quarter loss was lower than the Zacks Consensus Estimate. Also, revenues of $122.9 million were above the Zacks Consensus Estimate.

For the upcoming quarter, Box expects revenues in the range of $128-$129 million. The Zacks consensus estimate is pegged at $128.6 million. We expect the company to continue delivering robust top-line growth in the fiscal third quarter driven by strength across international markets, including EMEA and Japan, and growing add-on products.

Also, the company has been continuously investing in security, compliance and administrative technology, and has plans of hiring more sales personnel. These investments and partnerships with leading enterprises, namely Cognizant, Google (NASDAQ:GOOGL) and Adobe among others, will help the company to capitalize on increasing adoption of cloud computing technologies and the need for secure collaboration.

However, continuous investments in research and development could dent margins as well as profits going ahead.

On a non-GAAP basis, the company projects loss per share in the range of 13 cents to 14 cents for the upcoming quarter. The Zacks Consensus Estimate is pegged at loss of 13 cents.

What Our Model Suggests

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if these have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Box has a Zacks Rank #3 but an Earnings ESP of -1.96%, a combination that does not suggest that the company is likely to beat.

Box, Inc. Price and EPS Surprise

Stocks to Consider

You could consider the following stocks with a positive Earnings ESP and a favorable Zacks Rank.

NVIDIA Corporation (NASDAQ:NVDA) with an Earnings ESP of +1.31% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

VMware, Inc. (NYSE:VMW) with an Earnings ESP of +0.79% and a Zacks Rank #3.

Broadcom Limited (NASDAQ:AVGO) with an Earnings ESP of +0.51% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Box, Inc. (BOX): Free Stock Analysis Report

Vmware, Inc. (VMW): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.