- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Assai Continue To Drive Growth At Companhia Brasileira?

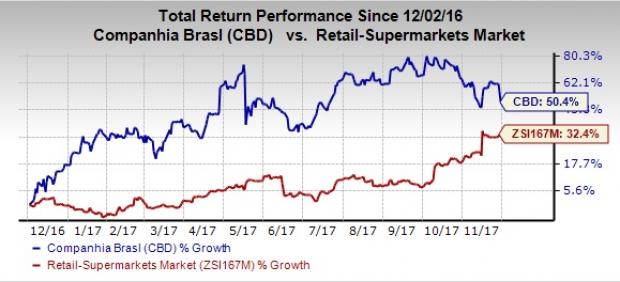

Companhia Brasileira de Distribuicao (NYSE:CBD) has seen its shares rally 50.4% over a year, in comparison with the industry’s surge of 32.4%. While the company has been gaining from continued market share gains at its Assai and Multivarejo segments, we believe that Assai remains its major growth driver. So, let’s delve deeper into these factors and see if they can continue to drive Companhia Brasileira amid a tough Brazilian environment.

Assai: A Major Growth Driver

Companhia Brasileira’s Assai segment, which has long been the company’s major growth driver, remained the highlight of its third-quarter 2017 performance as well. Notably this quarter marked Assai’s strongest quarter of combined volume and traffic growth in the recent times. In the third quarter, sales at this segment surged 25.2%, adjusted for the calendar effect. The sturdy growth was driven by higher comps and contributions from new stores.

Despite major food deflation in some key categories, Assai’s comps grew 7.7%, on the back of improved customer traffic and sales volume. Further, Assai contributed about 43% to the company’s total food sales, marking 600 bps growth from the year-ago period. Also, the segment witnessed market share gains of 330 bps year over year. Notably, management remains committed toward converting Extra Hiper stores into Assai stores, to optimize its portfolio. This clearly reflects robust prospects from this segment.

Apart from Assai, the company has also been gaining from improved volumes of Pao de Acucar and consistent recovery at Extra Hiper, which have been driving its Multivarejo segment. Evidently, the company’s third-quarter sales jumped 8.1% (adjusted for calendar effect), with comps rising at both segments. Also, adjusted EBITDA jumped 11.4%, with the EBITDA margin expanding 20 bps to 5%, fueled by improvements at both Multivarejo and Assai. For 2017 too, management envisions Food segment EBITDA margin of approximately 5.5%, backed by greater profitability at both divisions.

Further, the company remains focused on enhancing its food business, by making investments in Assai and Pao de Acucar, which are yielding solid returns. All said, the company anticipates continued market share gains at both its segments.

While macroeconomic headwinds in the Brazilian retail space and stiff competition in the appliances business may act as deterrents, we believe that strength in Assai is likely to help this Zacks Rank #3 (Hold) stock sustain its momentum.

Looking for More Promising Stocks? Check These

Wal-Mart Stores Inc. (NYSE:WMT) , with a Zacks Rank #2 (Buy) flaunts a splendid earnings surprise history. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar General Corporation (NYSE:DG) carrying a Zacks Rank #2 has an impressive long-term earnings growth rate of 11.3%.

Ross Stores, Inc. (NASDAQ:ROST) delivered an average positive earnings surprise of 5.5% in the trailing four quarters and has a long-term earnings growth rate of 10%. The company carries the same Zacks Rank as Dollar General.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Companhia Brasileira de Distribuicao (CBD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.