- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Adobe Systems (ADBE) Beat Earnings Estimates In Q1?

Adobe Systems Inc. (NASDAQ:ADBE) is set to report fiscal first-quarter 2018 results on March 15. Last quarter, the software giant delivered a positive earnings surprise of 9.6%.

The surprise history has been strong in Adobe’s case. The company surpassed estimates in each of the trailing four quarters, with an average positive surprise of 9.03%.

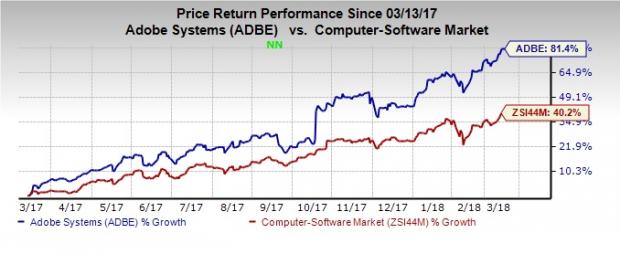

On a 12-month basis, the company’s shares have returned 81.4% compared with the industry’s rally of 40.2%.

Strength in Digital Media Business

Revenues from Digital Media Solutions surged 29% year over year to $1.39 billion in the last quarter. Total Digital Media ARR (Annualized Recurring Revenues) totaled $5.23 billion. For the quarter under review, the Zacks Consensus Estimate for total Digital Media ARR is expected at $5.63 billion, driven by strong growth in the Creative Cloud and Document Cloud business lines.

The segment comprises Creative Cloud (CC) and Document Cloud (DC). In the last quarter, Creative ARR increased $3.15 billion and Creative revenues totaled $1.16 billion, up 30% from the year-ago quarter. Creative ARR is projected at $5 billion, driven by net-new subscriptions, adoption of enterprise services and focus on high-potential segments like education. Also, CC revenues for the upcoming quarter are expected to be $1.21 billion.

Also, DC ARR are expected to increase to $631 million in the upcoming quarter, driven by Adobe Sign, which is now Microsoft’s preferred e-signature solution across the company’s portfolio.

Strength in Digital Marketing Business

Within the Digital Marketing segment, Adobe Experience Cloud revenues were up 18% year over year to $550 million. Adobe Experience Cloud includes Adobe Marketing Cloud, Adobe Analytics Cloud and Adobe Advertising Cloud. For the upcoming quarter, Adobe Marketing Cloud revenues are expected at $552 million, up from $550 million in the prior quarter. The new capabilities in Adobe Target will further enhance customer recommendations and targeting, optimize experiences, and automate the delivery of personalized offers.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) along with a positive Earnings ESP has a good chance of beating estimates. Sell-rated stocks (Zacks Rank #4 or 5) are best avoided.

Adobe has a Zacks Rank #2 and an Earnings ESP of -0.25%, not indicating a likely positive surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks to Consider

You may also consider the following stocks with a positive Earnings ESP and a favorable Zacks Rank:

EVINE Live Inc. (NASDAQ:EVLV) has an Earnings ESP of +13.79% and Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

FactSet Research Systems Inc. (NYSE:FDS) has an Earnings ESP of +0.18% and a Zacks Rank #3.

eBay Inc. (NASDAQ:EBAY) has an Earnings ESP of +0.44% and a Zacks Rank #3.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

FactSet Research Systems Inc. (FDS): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

EVINE Live Inc. (EVLV): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.