- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Ulta Beauty (ULTA) Fell Despite Q3 Earnings Beat?

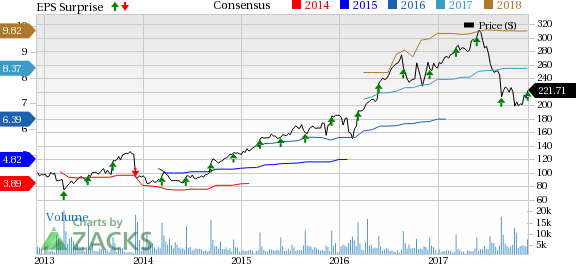

Ulta Beauty, Inc. (NASDAQ:ULTA) , which has been delivering positive earnings and sales surprises consistently for more than three years, kept its earnings streak alive in third-quarter fiscal 2017 as well. Though, sales missed the Zacks Consensus Estimate, both the top and bottom lines improved year over year. Also, management reaffirmed its outlook for the year.

Results in the quarter were fueled by market share gains and benefits from compelling offers through the company’s impressive loyalty program. Growth across all product categories, where prestige cosmetics continued to outperform also added to the solid performance. Strong marketing initiatives, outstanding e-commerce improvement and continued progress at the company’s salon operations were the other elements that drove results.

However, shares of this cosmetics retailer lost 4.9% in the after-hours trading on Nov 30. Despite an earnings beat, investors punished the stock on its top-line miss, the first in more than three years. Also, management reiterated its fiscal 2017 guidance. Further, the company’s not so encouraging outlook for the final quarter also hurt investors' sentiments. Additionally, the rate of comparable store sales (comps) growth decelerated from the year-ago and sequential periods. The company’s gross and operating margins too declined in the quarter.

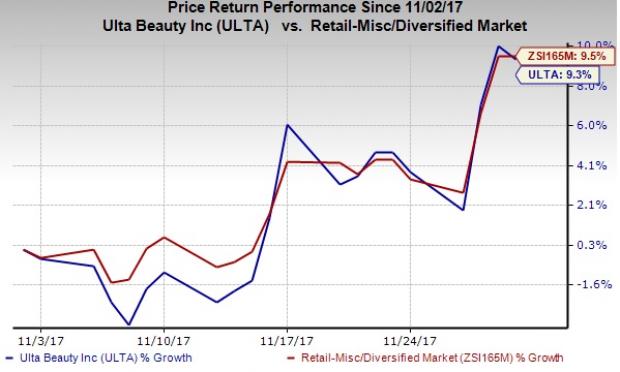

In the past one month, Ulta Beauty has gained 9.3% almost in line with the industry’s growth.

Robust Q3 Numbers

Coming to numbers, this Zacks Rank #3 (Hold) company posted adjusted earnings of $1.70 per share outpacing the Zacks Consensus Estimate of $1.67 and soared 21.4% year over year. This included favorable impacts of 4 cents from lower tax rate and 3 cents from lower share count, compensated with nearly 8 cents attributable to Hurricanes Harvey and Irma adverse impacts.

Net sales increased 18.6% year over year to $1,342.2 million but it marginally lagged the Zacks Consensus Estimate of $1,343 million. The year-over-year improvement in revenues was driven by solid comps growth and e-commerce sales.

Comps (including stores and e-commerce) improved 10.3% compared with 16.7% growth in the prior-year quarter. Comps growth came on the back of favorable traffic and ticket along with store growth and stupendous e-commerce improvement. During the third quarter, the company registered transaction growth of 6% while average ticket was up 4.3%. Nonetheless, the Hurricanes Harvey and Irma adversely impacted comps by about 100 basis points (bps).

Retail business (comprising retail and salon) witnessed comps growth of 6.6% that include 3.8% improvement for salon. Sales for the salon business grew 10.8% to $66.9 million. Also, Ulta Beauty witnessed whopping 62.9% growth in e-commerce sales to $119.8 million, reflecting about 370 bps of the total comps growth in the quarter.

Gross profit improved 15.5% year over year to $493.1 million. However, the gross profit margin contracted 110 bps to 36.7% due to deleveraged merchandise margins.

While operating income advanced 16.5% year over year to $162.7 million, operating margin declined 30 bps to 12.1%. The contraction in operating margin was owing to a fall in gross margin, somewhat offset by a 90 bps decline in SG&A expenses as a percentage of sales. However, pre-opening expenses escalated 40.6% to $9.7 million.

Other Financials

Ulta Beauty ended the quarter with cash and cash equivalents of $46.8 million, short-term investments of $60 million and shareholders’ equity of $1,616.1 million. Merchandise inventories totaled $1,349.7 million, marking an increase of 18.7% from the year-ago period. Average inventory per store increased 6.5%.

Net cash provided by operating activities came in at roughly $329.1 million in the nine months of fiscal 2017.

During the quarter, the company bought back 590,861 shares for a total of $131.7 million. On a year-to-date basis, it bought back 1,237,949 shares for $309.8 million. As of Oct 28, 2017, Ulta Beauty had about $136.4 million worth of authorization remaining under the $425 million buyback plan approved in March.

Store Updates

In the third quarter, Ulta Beauty opened 48 new stores. With this, the company stands to operate 1,058 stores, as of Oct 28, 2017 while increasing its total square footage by 11.3% year over year.

Going forward, the company plans to open roughly 100 new stores, remodel 11 stores and relocate seven outlets in the current year.

Guidance

Following the quarterly results, Ulta Beauty reiterated its outlook for fiscal 2017 and issued guidance for the fourth quarter. The company still expects to deliver comps growth (including e-commerce) in the range of 10-11% for the year. In the meantime, the company continues to anticipate its e-commerce sales growth in a range of 50-60%.

Consequently, management still envisions earnings per share growth to come in a high twenties percentage range. The Zacks Consensus Estimate for fiscal 2017 is pegged at $8.37. Earnings per share includes the impact of the additional 53rd week in the same period, which is likely to have nearly $370 million impact from share repurchases and the effect of tax rate benefit realized so far this year. However, the company will exclude all tax-related impacts from the adoption of the new accounting standard for the rest of fiscal 2017, alongside excluding impacts of Harvey and Irma.

Apart from this, Ulta Beauty intends to spend about $450 million toward capital expenditures in the year versus $460 million, projected earlier. This includes about $80 million to fund the expansion of prestige brand.

For the fourth quarter, the company anticipates net sales in a range of $1,926-$1,959 million compared with 1,580.6 million delivered in the prior-year quarter. The current Zacks Consensus Estimate is pegged at $1.92 billion. Comps, including e-commerce sales, are projected to grow in the range of 8-10% compared with 16.6% in third-quarter fiscal 2016.

Earnings per share for the impending quarter are expected in the band of $2.73-$2.78 compared with $2.24 in fourth-quarter fiscal 2016. The Zacks Consensus Estimate for the quarter is pegged higher at $2.83.

Interested in Retail? These Picks You Can’t Miss

Hibbett Sports, Inc. (NASDAQ:HIBB) sports a Zacks Rank #1 (Strong Buy) and has pulled off an average positive earnings surprise of 25.6% in the trailing four quarters. Also, it has a long-term earnings growth rate of 2.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Five Below, Inc. (NASDAQ:FIVE) , with an impressive long-term earnings growth rate of 28.5% carries a Zacks Rank #2 (Buy). Also, the company’s earnings have delivered an average positive surprise of 8.7% in the last four quarters.

KAR Auction Services, Inc. (NYSE:KAR) is another solid bet with a long-term earnings growth rate of 13.4% and Zacks Rank #2. Also, the company has delivered an average positive surprise of 7.3% in the last four quarters.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Ulta Beauty Inc. (ULTA): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

KAR Auction Services, Inc (KAR): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.