Looking for a stock that might be in a good position to beat earnings at its next report? Consider Callaway Golf Company (NYSE:ELY) , a firm in the Leisure and Recreation Products industry, which could be a great candidate for another beat.

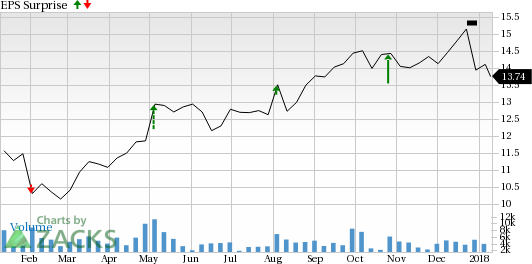

This company has seen a nice streak of beating earnings estimates, especially when looking at the previous two reports. In fact, in these reports, ELY has beaten estimates by at least 15% in both cases, suggesting it has a nice short-term history of crushing expectations.

Earnings in Focus

Two quarters ago, ELY expected to post earnings of 29 cents per share, while it actually produced earnings of 34 cents per share, a beat of 17.2%. Meanwhile, for the most recent quarter, the company looked to deliver a loss of 5 cents per share, when it actually saw earnings of 5 cents per share instead, representing a 200% positive surprise.

Thanks in part to this history, recent estimates have been moving higher for Callaway Golf. In fact, the Earnings ESP for ELY is positive, which is a great sign of a coming beat.

After all, the Zacks Earnings ESP compares the most accurate estimate to the broad consensus, looking to find stocks that have seen big revisions as of late, suggesting that analysts have recently become more bullish on the company’s earnings prospects. This is the case for ELY, as the firm currently has a Zacks Earnings ESP of +11.49%, so another beat could be around the corner.

This is particularly true when you consider that ELY has a great Zacks Rank #2 (Buy) which can be a harbinger of outperformance and a signal for a strong earnings profile. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

When you add this solid Zacks Rank to a positive Earnings ESP, a positive earnings surprise happens nearly 70% of the time, so it seems pretty likely that ELY could see another beat at its next report, especially if recent trends are any guide.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Callaway Golf Company (ELY): Free Stock Analysis Report

Original post