- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why McDonald's (MCD) Stock Keeps Climbing Higher

Shares of McDonald’s Corporation (NYSE:MCD) gained more than 1.6% in morning trading Tuesday after analysts from Jeffries upgraded the stock. Today’s gains were enough to send McDonald’s to a new all-time high, although the company owes its current peak to a year-long rally fueled by optimism surrounding its new-age initiatives.

“We find the combination of digital, remodels and delivery (with UberEats) will make a +3 percent U.S. same-store sales result very visible with potential upside depending on how quickly initiatives gain traction,” wrote Jefferies analyst Andy Barish.

Barish’s firm upgraded MCD to a “Buy” rating and set a price target of $200 for the stock. This bullish call represents a 17.2% upside from Monday’s closing price and is the currently the highest analyst price target for McDonald’s.

Jeffries is right to credit McDonald’s for its digital and delivery-related innovation. These new efforts have been a catalyst for the company’s current rally, which has witnessed its stock climb by a staggering 45% over the past year.

Barish estimates that McDonald’s will feature delivery services at 5,000 restaurants by the end of the year. In 2018, the analysts expects an additional 2,000 stores will add delivery, with the company eventually reaching a total of 10,000 locations with delivery options by the end of 2019.

And what some investors might underestimate is the fast-food behemoth’s unique ability to execute its strategies on an international level. As Barish highlights in his recent note, McDonald’s is already doing about $1 billion worth of delivery sales in the Middle East and Asia. About 75% of American citizens live within three miles of a McDonald’s, so that vision should easily translate in the United States.

McDonald’s is working exclusively with UberEats on its delivery mission. The food delivery wing of ride-hailing giant Uber charges a $4.99 fee per order, plus a commission from McDonald’s.

Barish estimates that delivery will contribute 0.5% to the company’s same-store sales this year. In 2018 and 2019, the analyst expects McDonald’s to post 3% same-store sales growth, thanks in large part to its delivery initiatives.

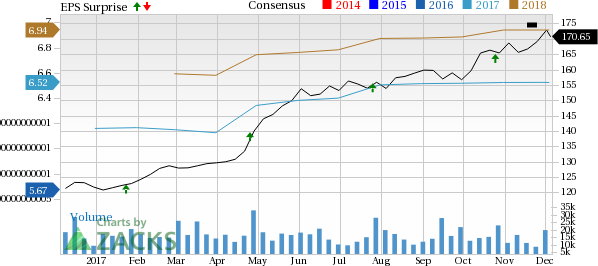

Our current consensus estimates are calling for McDonald’s to report earnings of $6.94 per share and revenues of $20.39 billion in the upcoming fiscal year. Total sales are expected to slump about 10% from 2017’s projected total, but earnings per share figures are expected to expand by an additional 6.4%.

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

McDonald's Corporation (MCD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.