- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Is Texas Instruments (TXN) Up 1.7% Since The Last Earnings Report?

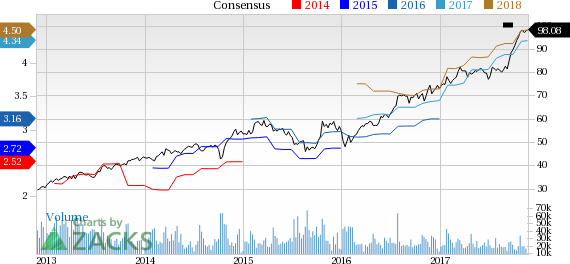

It has been about a month since the last earnings report for Texas Instruments Incorporated (NASDAQ:TXN) . Shares have added about 1.7% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Texas Instruments Beats on Earnings & Revenues in Q3

Texas Instruments or TI reported better-than-expected third-quarter 2017 results, beating the Zacks Consensus Estimate on both counts. Earnings of $1.26 per share beat the consensus mark by 14 cents, increasing 34% year over year and 22.3% sequentially. Revenues of $4.15 billion beat the Zacks Consensus Estimate by $199 millionand were up 12% on a year-over-year basis and 11.5% sequentially. It came ahead of the guided range of $3.74–$4.06 billion.

Revenues in Detail

Analog, Embedded Processing and Other segments generated 65%, 23% and 12% of quarterly revenues, respectively.

Analog, which includes Power, Signal Chain and High Volume products, was up 12% sequentially and 16% from the year-ago quarter to $2.7 billion. The year-over-year growth was driven by strong performance in product lines — power and signal chain.

The Embedded Processing segment, which includes Connected Microcontrollers and Processors, was up 7% sequentially and 17% year over year to $931 million. The year-over-year growth was driven by stronger sales across both product lines — processors and connected microcontrollers.

The Other segment, which includes DLPs, custom ASICs and calculators, was up 18% sequentially but down 13% year over year. The decline was mainly due to custom ASIC and royalties moving to other income and expenses beginning in the first quarter of 2017.

Margins and Net Income

Texas Instruments’ gross margin of 64.5% was up 24 basis points (bps) sequentially and 249 bps from the year-ago quarter. The company’s gross margin has been improving consistently as more production shifts to its 300mm line. Operating expenses of $868 million were down 2.9% sequentially and 2.9% from last year. Operating margin was 43.4%, up 336 bps sequentially and 573 bps from the year-ago quarter.

The Analog, Embedded Processing and Other segments generated operating margin of 31%, 8% and 5%, respectively. Analog and Embedded Processing segment margin expanded 200 bps and 100 bps respectively while the Other segment stayed flat on a sequential basis. Analog and Embedded margins expanded 500 bps and 200 bps respectively while Other segment margin contracted 100 bps year over year.

Pro forma net income was $1.29 billion, or a 31.2% net income margin compared with $1.1 billion, or 28.6% in the previous quarter and $959 million, or 26.1% in the year-ago quarter.

Balance Sheet and Cash Flow

Cash and short-term investments balance was $3.4 billion, up $400 million during the quarter. The company generated $1.7 billion in cash from operations, spending $186 million on capex, $650 million on share repurchases and $495 million on cash dividends. Texas Instruments is one of the few technology companies that return a significant amount of cash to investors. Over the trailing 12 months, the company has returned 4.3 billion of cash through a combination of dividends and stock repurchases. At quarter-end, TI had $3.1 billion in long-term debt and $499 million in short-term debt. As of Mar 31, 2017, the company’s net debt position was $139 million.

Guidance

The company provided guidance for the fourth quarter. It expects revenues between $3.57 billion and $3.87 billion (down 10.8% sequentially at the mid-point). The mid-point of the guidance is higher than the Zacks Consensus Estimate of $3.67 billion. The effective tax rate for the fourth quarter is expected to be around 29%. Earnings for the quarter are expected to be in the range of $1.01 to $1.15 per share. The lower end of the range is in line with the Zacks Consensus Estimate. The capex target remains at 4% of revenues.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been six revisions higher for the current quarter. In the past month, the consensus estimate has shifted by 7.6% due to these changes.

VGM Scores

Currently, Texas Instruments' stock has an average Growth Score of C, however its Momentum is doing a bit better with a B. The stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than growth investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. It comes with little surprise that the stock has a Zacks Rank #1 (Strong Buy).

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.