- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Is Colgate-Palmolive (CL) Down 9.1% Since Its Last Earnings Report?

It has been about a month since the last earnings report for Colgate-Palmolive Company (NYSE:CL) . Shares have lost about 9.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to its next earnings release, or is CL due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Colgate's Q4 Earnings In Line, Sales Lag

Colgate-Palmolive Co. posted adjusted earnings of 75 cents a share in fourth-quarter 2017, in line with the Zacks Consensus Estimate and flat with the prior-year quarter. Including one-time items, earnings came in at 37 cents a share compared with 68 cents reported in the year-ago period.

Total sales of $3,892 million improved 4.5% from the year-ago period but lagged the Zacks Consensus Estimate of $3,916 million. The top line gained from 3% increase in global unit volumes and favorable currency impact of 2.5%, offset by 1% decline in pricing. Further, strong volume gains in Latin America, North America and Europe aided sales growth.

On an organic basis (excluding foreign exchange, acquisitions and divestitures), the company’s sales jumped 2%.

Deeper Insight

Adjusted gross profit margin of 60.4% contracted 40 bps from the prior-year quarter driven by higher raw and packaging material expenses and lower pricing. However, this was partially offset by gains from the cost-saving initiatives under the company’s funding-the-growth program.

In the reported quarter, adjusted operating profit of $1,011 million dipped 3%, with the adjusted operating margin contracting 190 bps to 26%. Operating margin decline can be attributed to 160 bps rise in adjusted selling, general & administrative expenses as a percentage of sales, which included higher investments in advertising.

Year to date, Colgate’s market share of manual toothbrushes has reached 32.6%. Further, the company continued with its leadership in the global toothpaste market with 43.3% market share year to date.

Segment Discussion

North America net sales (21% of total sales) rose 1%, reflecting a 4.5% increase in unit volumes offset by 3.5% fall in pricing. However, currency impacts were flat with last year. On an organic basis too, sales improved 1%.

Latin America net sales (25% of total sales) jumped 4% year over year gaining from 4% volume gains and positive currency impact of 1.5%, partly negated by 1.5% decline in pricing. Volume growth can mainly be attributed to increase in Brazil and the Southern Cone and Andean regions, partially mitigated by lower volumes in Mexico and Central America. On an organic basis, sales increased 2.5%.

Europe net sales (16% of total sales) rose 13% year over year, due to 6% increase in unit volumes and a favorable currency impact of 9%, offset by 2% decline in pricing. Unit volumes gained from strength in France, Italy and Germany. Europe organic sales were up 4%.

Asia Pacific net sales (17% of total sales) rose 6%, attributable to 1% increase in unit volume, 1.5% higher pricing and positive currency impacts of 3.5%. Volumes in the quarter benefited from strength in India, which was partly neutralized by declines in the Greater China and the Philippines regions. On an organic basis, sales for Asia Pacific were up 2.5%.

Africa/Eurasia net sales (6% of total sales) jumped 2% year over year, fueled by 2.5% gains from positive currency, partly offset by 0.5% drop in unit volumes while pricing was flat. Lower volumes in the Sub-Turkey and the North Africa/Middle East regions, were partly offset by gains in Russia and the Sub-Saharan Africa region. Organic sales for Africa/Eurasia dropped 0.5%.

Hill’s Pet Nutrition net sales (15% of total sales) were up 2.5% from the year-ago quarter. Results gained from 0.5% increase in pricing and 2% positive impact from currency, while unit volumes remained flat. Volume gains in the United States and Australia were offset by fall in Japan, France and South Africa. On an organic basis, sales rose 0.5%.

Other Financial Details

Colgate ended the year with cash and cash equivalents of $1,535 million and total debt of $6,577 million. Net cash provided by operating activities came in at $3,054 million 2017.

Outlook

Looking into 2018, Colgate anticipates the backdrop to remain challenging due to uncertain global markets and slowing category growth worldwide. However, the company remains on track with its brand building and productivity maximization initiatives. Consequently, the company expects net sales to increase in the mid-single-digit range, while organic sales growth of low to mid-single-digit is likely in 2018.

Including the impact of the expanded Global Growth and Efficiency Program, the company continues to expect gross margin expansion for 2018, along with double digits increase in GAAP earnings per share.

Excluding the restructuring charges resulting from the program and other one-time expenses associated with U.S. tax reform in 2017, the company projects strong cash flow generation, gross margin expansion and higher advertising investments in 2018. Further, the company anticipates low double digit earnings per share growth for the year, on an adjusted basis.

Accounting for the U.S. tax reform, the company anticipates 2018 tax of 26-27%, both on a GAAP basis and excluding the impact of the Global Growth and Efficiency Program.

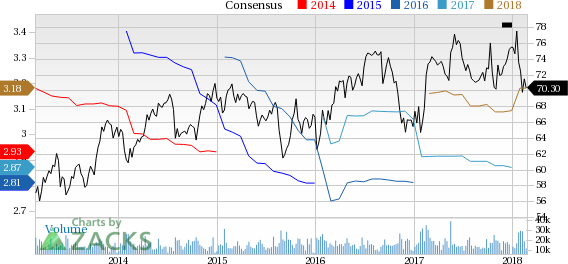

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower.

VGM Scores

At this time, CL has a nice Growth Score of B, though it is lagging a bit on the momentum front with C. However, the stock was also allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is more suitable for growth than momentum investors.

Outlook

CL has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Original post

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.