- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Delek US Holdings (DK) Could Be Positioned For A Surge

Delek US Holdings, Inc. (NYSE:DK) is a diversified energy business that could be an interesting play for investors. That is because, not only does the stock have decent short-term momentum, but it is seeing solid activity on the earnings estimate revision front as well.

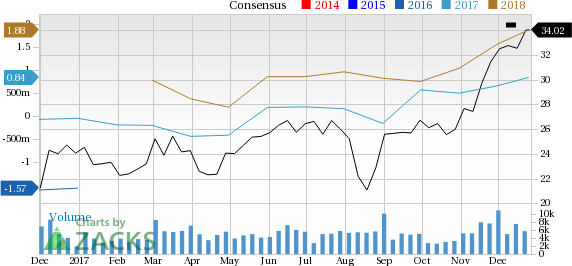

These positive earnings estimate revisions suggest that analysts are becoming more optimistic on DK’s earnings for the coming quarter and year. In fact, consensus estimates have moved sharply higher for both of these time frames over the past four weeks, suggesting that Delek US Holdings could be a solid choice for investors.

Current Quarter Estimates for DK

In the past 30 days, four estimates have gone higher for Delek US Holdings while none have gone lower in the same time period. The trend has been pretty favorable too, with estimates increasing from 24 cents a share 30 days ago, to 35 cents today, a move of 45.8%.

Current Year Estimates for DK

Meanwhile, Delek US Holdings’ current year figures are also looking quite promising, with five estimates moving higher in the past month, compared to none lower. The consensus estimate trend has also seen a boost for this time frame, increasing from 66 cents per share 30 days ago to 84 cents per share today, an increase of 27.3%.

Delek US Holdings, Inc. Price and Consensus

Bottom Line

The stock has also started to move higher lately, adding 6.3% over the past four weeks, suggesting that investors are starting to take note of this impressive story. So investors may definitely want to consider this Zacks Rank #1 (Strong Buy) stock to profit in the near future. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.