- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Abercrombie's (ANF) Estimates Surged Post Q3 Earnings?

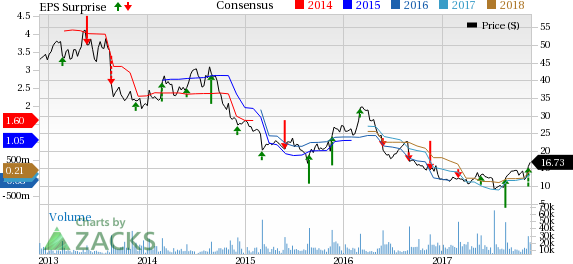

Apparel retailer, Abercrombie & Fitch Company (NYSE:ANF) is progressing well on its growth path driven by strategic capital investments, cost saving efforts along with loyalty and marketing programs. Further, the company’s robust surprise trend in recent quarters is aiding performance. The positive effects of these elements are clearly visible in the company’s solid stock movement and estimate revisions trend. Additionally, a VGM Score of A makes this Zacks Rank #3 (Hold) company a safe haven stock.

Stock on the Rise

Shares of Abercrombie have climbed 32.7% in the last three months, outperforming the industry’s upside of 15.1%. Additionally, the stock has witnessed solid growth of 33.3% after reporting better-than-expected results on Nov 17.

The company delivered earnings and sales beat in third-quarter fiscal 2017, marking the second straight positive earnings surprise and the third consecutive sales beat. Further, it remains encouraged by comps performance as it marked the fourth consecutive quarter of sequential improvement. Results gained from significant progress on strategic initiatives and strength in Hollister as well as direct-to-customer business. (Read More: Abercrombie Beats on Q3 Earnings & Sales, Stock Up)

Favorable Estimate Revisions

Following the upbeat quarter, the company provided an encouraging view for fourth-quarter fiscal 2017, which led to an uptrend in estimates.

The Zacks Consensus Estimate has witnessed an uptrend in the last 30 days. Notably, the estimate of 85 cents per share for the fourth quarter moved up by 5 cents per share. Additionally, the Zacks Consensus Estimate for fiscal 2017 and 2018 climbed substantially to 11 cents and 21 cents per share, respectively, from previous estimate of a loss of 1 cent and earnings of 1 cent.

Apart from a strong third-quarter, the company is gaining from a significant progress on strategic initiatives and strength in Hollister as well as direct-to-customer business, amid a highly promotional retail backdrop. Moreover, the company anticipates foreign currency to be a tailwind, reflecting slight gains in sales and operating income. So, here is a sneak peek into the company’s initiatives that are fueling growth.

Other Catalysts

Abercrombie remains focused on reviving its brands, enhancing performance and returning to profitable growth. Consequently, the company has been implementing several steps to spur its business forward. These initiatives include improving leadership team and organizational structure; optimizing store fleet by introducing stores in high-performing markets, while closing the underperforming ones; remodeling stores along with improving assortments to meet changing trends and demands; developing omni-channel capacities as well as focusing on key merchandise and design processes.

Also, it keeps discounts low along with a check on promotional activities, in an attempt to enhance margins. We believe that the company is very much on track to bring a turnaround as management expects these efforts to revive its iconic brands along with driving notable and sustained growth.

As part of streamlining efforts, the company has shifted focus to closing underperforming U.S. chain stores in order to drive top-line growth, while enhancing profitability. Store closure is anticipated to give Abercrombie more flexibility in terms of cost savings, amid a tough environment, where retailers are facing intense competition from continued shift to online shopping.

In third-quarter 2017, the company closed three Abercrombie and one Hollister stores in the United States, while it opened two new Abercrombie stores. The company expects to introduce four full-price stores in the fiscal fourth-quarter, following five stores opened year to date that includes two outlet stores. Additionally, it plans to shutter nearly 60 stores in the United States by the end of the fiscal year through natural lease expirations. This includes 14 stores which have been closed year to date.

3 More Stocks That Witnessed Positive Estimate Revisions Lately

The fourth quarter and fiscal 2018 consensus mark for Hibbett Sports Inc. (NASDAQ:HIBB) has moved up by 1 cent and 8 cents, respectively, to 25 cents per share and $1.42 per share in the last 30 days. This sporting goods retailer sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Dollar Tree, Inc. (NASDAQ:DLTR) has seen estimates for the fourth quarter and fiscal 2017 increase from $1.80 to $1.85 and $4.66 to $4.81, respectively in the past seven days. This discount store retailer carries a Zacks Rank #2 (Buy).

Ross Stores’ (NASDAQ:ROST) earnings estimates for fiscal 2017 have increased by one cent to $3.28 in the last seven days. The discount store retailer currently carries a Zacks Rank #2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.