Almost daily, there’s a new piece of information coming out about the Chinese economy that suggests economic conditions there are worsening. We see China’s manufacturing sector is contracting and there’s a credit crunch in the making.

The Wall Street Journal ran a story last Friday on the state of the Chinese economy and its rapid decline in growth. It cited Premier Li Keqlang’s warning to investors that China was “likely to see some corporate defaults in debts.” (Source: “China Reports Broad Economic Slowdown,” Wall Street Journal, March 14, 2014.)

The economic slowdown in the Chinese economy is another reason why the U.S. economy will slow down in 2014.

Too often investors forget that China is one of our major trading partners and a significant number of American companies operate in China. If the economic slowdown in the Chinese economy gains strength, then those American companies selling goods to China and those operating there will see their profits shrink.

As the Chinese economy boomed over the past 10 years, the prices of copper and other base metals needed in the building of the country’s infrastructure skyrocketed. Now, with an economic slowdown looming in the air for the Chinese economy, base metal prices, especially copper prices, are sliding lower.

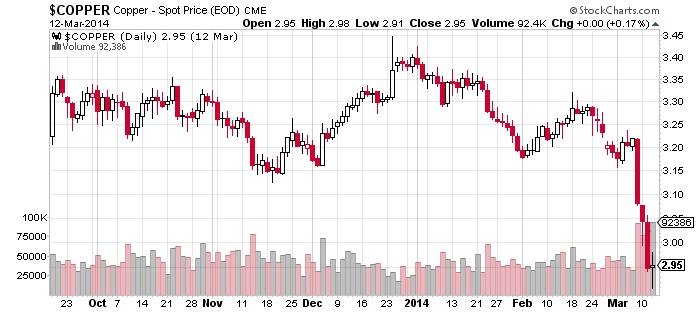

The chart below shows how copper prices have declined significantly since the beginning of 2014.

Chart courtesy of www.StockCharts.com

How will lower copper prices affect North American investors? Those companies in the U.S. economy that deal with base metals, such as copper, will see their profitability decline; thus, their stock prices will decline.

On a macro scale, the sharp decline in copper prices is ominous for the stock market as historically, the two have moved in tandem, up or down. Copper prices and the stock market both bottomed out in March of 2009. They both rallied from there right into 2011. While stock prices continued to rise after 2011, cooper prices stayed pretty well flat. Now, copper prices have collapsed…and I don’t think the stock market is far from following copper’s price direction lower.