- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

WestRock (WRK) Hits 52-Week High: What's Driving The Stock?

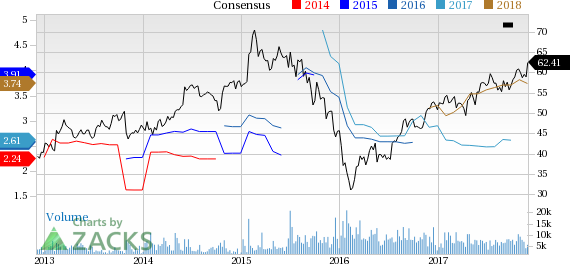

Shares of WestRock Company (NYSE:WRK) scaled a 52-week high of $62.61 on Nov 30, eventually closing lower at $62.41. The gain is driven by WestRock’s solid performance in fiscal 2017, encouraging outlook for fiscal 2018, as well as its focus on acquisitions.

The company has a market cap of $15.7 billion. Over the last three months, its average volume of shares traded is approximately 1.5M. Also, WestRock surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average positive earnings surprise of 10.03%.

Price Performance

Notably, the stock has gained 22.6% in a year’s time, higher than the S&P 500’s gain of 20.2%. WestRock has also outperformed the industry’s gain of 18.1% during the same time frame with respect to price performance.

Favorable Rank & Style Score

This Zacks Rank #3 (Hold) company has an impressive VGM Score of A. In this V stands for Value, G for Growth and M for Momentum, and the score is a weighted combination of these three scores. Such a score eliminates the negative aspects of stocks and select winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

Our research shows that stocks with Style Scores of A or B, when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3, offer the best investment opportunities.

What Led to the 52-Week High?

WestRock’s shares have gained nearly 5% since it reported fourth-quarter and fiscal 2017 results on Nov 2. Its adjusted earnings of 87 cents per share in the fiscal fourth quarter beat the Zacks Consensus Estimate by a margin of 7%. Sales also beat the consensus estimates and rose 12.4% year over year.

Backed by the overall industry conditions and positive volume and pricing dynamics, the company anticipates strong growth in fiscal 2018. Net sales growth is projected to be up approximately 10% year over year, translating to revenues of around $16.3 billion.

Notably, WestRock remained active on the acquisition front during fiscal 2017. The company acquired Multi Packaging Solutions International Limited — a leading global provider of print-based specialty packaging solutions — which will strengthen the company’s differentiated portfolio of paper and packaging solutions, along with expanding presence in attractive end markets. WestRock also acquired certain operations of U.S. Corrugated Holdings, Inc.

In August 2017, WestRock acquired Hanna Group Pty Ltd, one of Australia’s leading providers of folding cartons to a variety of markets. This buyout will expand WestRock’s consumer packaging portfolio as well as fortify its established and growing packaging business in Australia.

In a bid to tap the growing demand for corrugated packaging, WestRock has bought the assets of Island Container Corp. and Combined Container Industries LLC — two independent producers of corrugated boxes, sheets and point-of-purchase displays.

WestRock also continues to execute well on disciplined capital-allocation strategy. The company bought back $93 million of stock in fiscal 2017. During the fiscal, it paid $403 million as dividends. In October 2017, WestRock hiked its annual dividend by 7.5% to $1.72 per share. Meanwhile, the company also invested $779 million in capital to maintain and improve manufacturing assets.

The above-mentioned tailwinds raised investors’ optimism on the stock and are anticipated to boost the company’s share price in the days ahead.

Stocks to Consider

Better-ranked stocks in the same space include Sappi Limited (OTC:SPPJY) , Stora Enso Oyj (OTC:SEOAY) and UPM-Kymmene Oyj (OTC:UPMKY) . All three stocks carry a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sappi Limited has a long-term earnings growth rate of 7.6%. Its shares have been up 10.3% year to date.

Stora Enso has a long-term earnings growth rate of 9.6%. Its shares have gained 43.7% during in the year so far.

UPM-Kymmene has a long-term earnings growth rate of 5.1%. Its shares have gained 22.2% during the same time frame.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Sappi Ltd. (SPPJY): Free Stock Analysis Report

UPM-Kymmene Corp. (UPMKY): Free Stock Analysis Report

Westrock Company (WRK): Free Stock Analysis Report

Stora Enso Oyj (SEOAY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.