- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

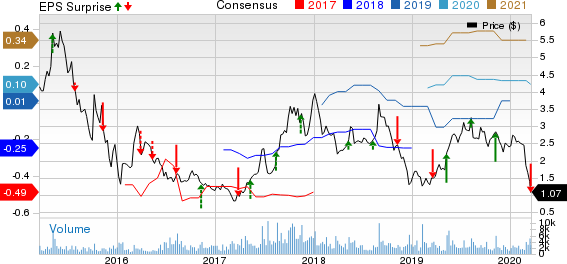

Westport (WPRT) Q4 Earnings Breakeven, Sales Beat Estimates

Westport Fuel Systems Inc. (NASDAQ:WPRT) reported break-even earnings per share in fourth-quarter 2019, as against the Zacks Consensus Estimate of a loss of a penny. The metric also compared favourably with the year-ago quarter’s loss of 8 cents a share. Higher revenues and lower operating expenses led to this outperformance.

Net income from continuing operations in the reported quarter was $0.7 million, as against net loss of $10.4 million posted in fourth-quarter 2018.

Westport logged consolidated revenues of $74.3 million in the fourth quarter, up 23% year over year, mainly on strength in its transportation businesses and higher HPDI revenues. Moreover, the company’s revenues surpassed the Zacks Consensus Estimate of $71 million.

During the reported quarter, consolidated gross margin increased to $13.8 million from the prior year’s $12.3 million. Adjusted EBITDA amounted to $3.6 million compared with the prior-year quarter’s $0.2 million.

Operational Results

Transportation Business Segment: Net sales of the segment increased 23% year over year to $74.3 million in the reported quarter on solid revenues from the OEM business, mainly driven by higher HPDI 2.0 product sales. The segment’s gross margin rose to $13.8 million from $12.3 million in fourth-quarter 2018, aided by higher revenues during the current quarter.

CWI Joint Venture: This segment’s revenues totaled $102.5 million, up from the year-ago quarter’s $94.1 million on higher sales volume. Gross margin was $28.3 million, up from the fourth-quarter 2018 level of $21 million owing to higher revenues and lower warranty expense.

Corporate Business Segment: Corporate R&D expenses slumped 150% year over year from the $0.2 million recorded in the fourth quarter of 2018. The segment’s SG&A expenses came in at $3.8 million, down from the fourth-quarter 2018 level of $6.9 million, mainly owing to a reduction in legal cost for the Securities and Exchange Commission (SEC) investigation.

Financial Position

Westport had cash and cash equivalents of $46 million as of Dec 31, 2019, down from $61.1 million as of Dec 31, 2018. Long-term debt declined to $48.9 million in the reported quarter from $55.3 million as of Dec 31, 2018. The debt-to-capital ratio stands at 35.36%, as of Dec 31, 2019.

For the year ended Dec 31, 2019, the company’s net cash used in operating activities of continuing operations was $15.7 million compared with $27.4 million as of Dec 31, 2018.

Zacks Rank & Stocks to Consider

Westport currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Fox Factory Holding Corp. (NASDAQ:FOXF) , Blue Bird Corp. (NASDAQ:BLBD) and Polaris Industries (NYSE:PII) . While Fox Factory carries a Zacks Rank #1 (Strong Buy), Blue Bird and Polaris carry a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Polaris Industries Inc. (PII): Free Stock Analysis Report

Westport Fuel Systems Inc. (WPRT): Free Stock Analysis Report

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Blue Bird Corporation (BLBD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.