- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

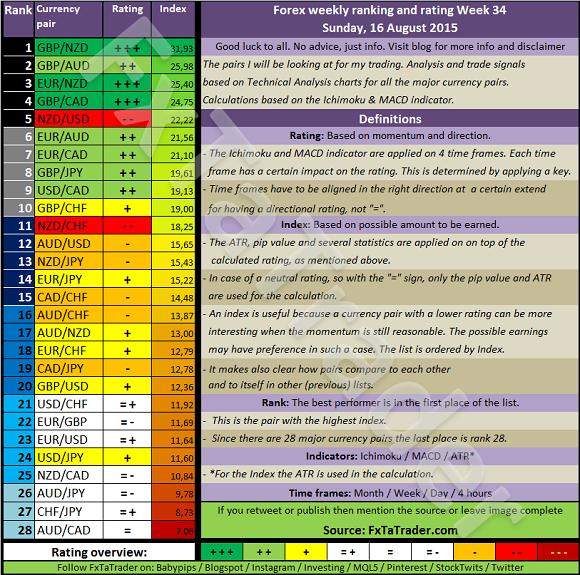

Weekly Ranking And Rating, Week 34: Sunday, August 16, 2015

Besides the Ranking and Rating list provided here, I will also prepare this weekend the Weekly Currency Score list, which will support my analysis for trading in the coming week, which is then followed by my review on the FxTaTrader strategy.

When looking at the Top 10 in the Weekly Ranking and Rating list, we can see that for the coming week, the following stronger currencies are well represented for going long: GBP (5X) followed by the EUR (3X). The weaker currencies are the NZD (3X) followed by the CAD (3x) with the AUD (2X).

A nice combination for coming week may be e.g:

These are just a few examples and many other combinations are possible. The mentioned pair combinations can be traded at the same time according to the rules of the FxTaTrader strategy because these are all different currencies. By not trading the same currency in the same direction more than once, you may have better chances with lower risk.

More details on the (possible) traded pairs will be provided in my strategy article that will also be published this weekend. The possible positions for this coming week for the strategy will then also be described.

Weekly Ranking and Rating List Week 34 / Sunday, August 16, 2015

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every week, the forex ranking rating list will be prepared in the weekend. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

There will be 2 updates during the week on Tuesday and Wednesday. The Daily and 4 Hour chart will then be analyzed and updated.

This makes that there will be no more than 48 trading hours between each update. This is a reasonable period when considering that the smallest time frame used is the 4 hours, meaning 12 price bars/candlesticks.

The forex ranking and rating list is meaningful data for my FxTaTrader strategy. Besides this list, I also use the Currency Score, which is also available once a week on my blog at FxTaTrader.com together with my weekly analysis on my Strategy.

If you would like to use this article, then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week, and don't forget to check my weekly forex "Strategy Review" and the "Currency Score."

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market, as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments.

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

CHF/JPY Forex Strategy is Bearish: We are currently @ 166.78 in a range. If we can break slope support, we are looking for a continuation to the ATR target @ 165.97 area, with a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.