- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Week Ahead: Wild Swings Renew As Conviction Flips From QE Relief To Virus Fear

- New U.S. bull begins on QE relief despite staggering job loss

- The U.S. is now the official global COVID-19 hotspot

- Investors brace for an earnings season with no clue what to expect

As another earnings season approaches, investors find themselves with no clue as to how significantly COVID-19 has already pressured domestic as well as global growth. Ahead of the Good Friday and Easter holidays, the U.S. market abruptly shifted out of a bear market and shockingly, seems to have started a new bull run as the S&P 500, Dow Jones, NASDAQ and Russell 2000 each closed higher on Thursday to finish the shortened trading week.

Wild Fluctuations, Irrational Expectations

In previous posts, both daily and weekly, we've warned of savage whipsawing. Nonetheless, we didn’t expect indices to fluctuate this wildly.

Still, though stocks came back from the dead last week—driven by the Fed pledging additional, $2.3-billion in stimulus in the face of another week of overwhelming jobless numbers because of coronavirus lockdowns in the U.S., to be used as loans for small- and mid-sized businesses ravaged by the pandemic, and reports of a possible outbreak plateau as the number of cases slowed in Italy and Spain, even while hospitalizations in New York ticked lower—the picture has shifted once again.

Since Thursday’s close, the U.S. has officially earned the dubious honor of now being the world’s pandemic hotspot, with 529,951 confirmed cases as of the time of writing. Globally the case count has risen to 1,777,666 with 108,867 deaths.

Will this upend the rally when markets open on Monday? According to the Wall Street Journal, the outlook is unclear. The “Fed has firepower to do more after [its] $2.3 trillion aid blitz,” but going all in “poses new risks to its independence.” Plus, with Fed stimulus already propping up the markets, it also encourages irresponsible investing that could potentially create another bubble.

While investors weigh whether unprecedented, unlimited QE can offset the virus’s impact on the economy, “unemployment claims keep pouring in as states struggle to cope.” Including last week's massive initial claims applications, an overwhelming 16.8 million workers have filed new claims in the past three weeks, bringing the total of newly jobless to 1 in 10 American workers, in the last three weeks.

Still, despite what can only be described as catastrophic numbers for the country's economy, the S&P 500 jumped on Thursday, rising for the third day out of four to notch a 12% gain for the week. It was the benchmark index's best week in 46 years. The push higher added $4 trillion in value to the index's stocks, just a few weeks after losses had sliced off $10 trillion of that value. Perhaps more surprising, “stock market bulls hope that the S&P 500 will rally further even as corporate earnings crater."

Does that even make sense? We hardly think so. But we don’t control the market, which, at its essence, is nothing more than a glorified voting machine. The more money investors vote to put into it, the higher up it will go—whether the gains are rational or not. In our opinion the elevated valuations simply do not justify the risk, but we've been wrong before.

Indeed, we've been bearish on equities since March 3 and have restated that position in a variety of posts since then. Just last week, on April 5, we reiterated our outlook for another selloff.

Some readers, however, were confused when we reported, on April 7, that the S&P 500 had completed an uptrend. Some commentors asked what happened to the earlier bearish flag mentioned in last Sunday's post? Two words: it failed.

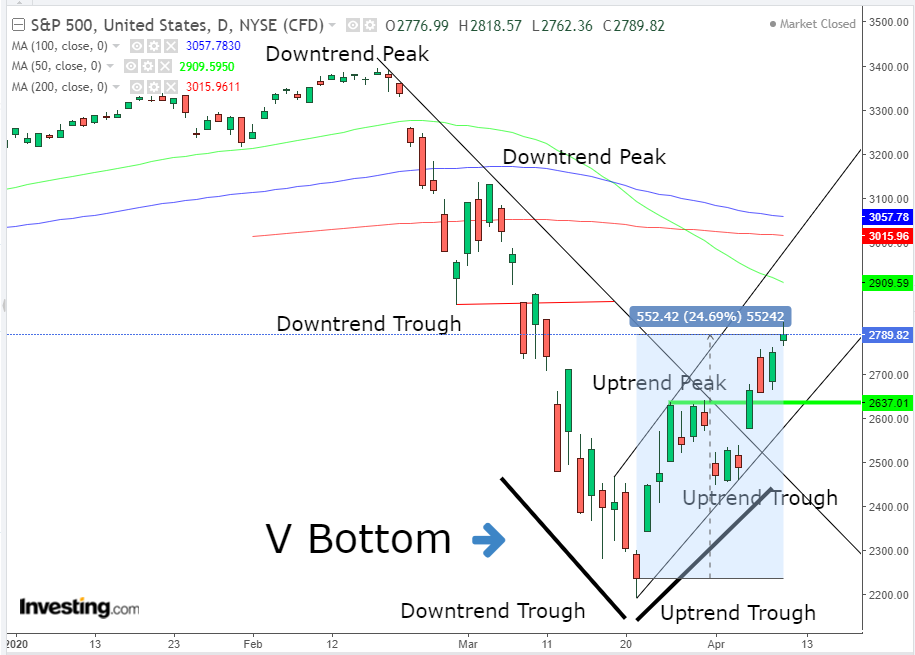

The market's activity never provided the presumed downside breakout; rather it blew out the pattern, breaking instead to the topside. While initially it looked to be forming a rising flag, the patterned morphed into a V-bottom, marked by the thick black lines.

As much as we hate to do this, based on the technicals we must reiterate our bullish call since last Tuesday. Yes, we strongly dislike the extreme valuations, the devastated job market and the fact that New York City, currently the epicenter of the U.S. coronavirus outbreak, also Wall Street's home, is the worst place in the world to be right now. However, up until such time as a new downtrend is established, we can only remain bullish.

Thursday’s trading formed a small candle, which may be a shooting star, though the lower shadow makes that a tricky call. Either way, the small body suggests the rally weakened, and the preceding gap sets it up for an Evening Star, a three-candle bearish pattern.

Should that play out, it would strengthen the view of at least a correction to the uptrend, which would probably be tested within the range of the 2,700 round number and uptrend line at the 2,630 (previous peak) level.

Since our initial bearish stand in early March, the SPX fell as much as 29% until March 23. But, since our uptrend call this past Tuesday, the benchmark climbed, rising another 5.8% as of Thursday’s close. Thus, according to an arbitrary market gauge, with a 24.6% rally since the March 23 bottom, a new bull trend has been initiated.

We can't say whether demand will keep outpacing supply in spite of the many risks, but we'll keep calling the trend as we see it, and expressing our opinion of it.

The dollar's uptrend, however, is now in question.

This occurred when the global reserve currency failed to post a higher peak, then fell below its uptrend line to boot. The decline followed an evening star which generally signals the end is near for an uptrend.

Adding strength to the bearish argument, gold futures closed above the $1,700 level for the first time since October 2012.

Last week we argued that yellow metal may challenge its record, and Peter Grosskopf, Chief Executive of asset manager Sprott said it may soar to a record $2,000.

Oil finished the week lower on trouble between Saudi Arabia and Russia, even as they were meeting to try and set aside their differences and agree on a production cut.

The devestating results of a price war on the heels of a global pandemic that's diminished national economies has savaged the commodity, causing a worldwide glut and forcing OPEC+ to retreat from threats to undercut American oil. The industry remains under the gun however, as Mexico refused to share the production cut burden. However the U.S. president said he "had proposed to help Mexico along." It's not clear though, if this will actually transpire.

Sector aAnalysts expect the current price to be the floor, while we see significant technical pressure above.

The Week Ahead

All times listed are EDT

Monday

Numerous global markets, inlcuding the UK, Germany, Italy, Singapore and Australia will be closed for the Easter Monday holiday.

Tuesday

17:32: China – Trade Balance: expected to soar to 19.10B from -7.09B.

Wednesday

8:30: U.S. – Core Retail Sales: seen to plunge to -3.0% in March from -0.4%; Retail Sales: likely plummeted to -7.0% from -0.5%.

10:00: Canada – BoC Interest Rate Decision: currently holding steady at 0.25%.

10:30: U.S. – Crude Oil Inventories: forecast to drop to 9.271M from 15.177M.

21:30: Australia – Employment Change: anticipated to have undergone a severe slump in March, to -40.0K jobs lost from +26.7K in February.

Thursday

4:00: Germany – Ifo Business Climate Index: previous reading was 86.1.

8:30: U.S. – Building Permits: expected to fall to 1.300M from 1.452M.

8:30: U.S. – Initial Jobless Claims: after last week's staggering print, markets await this week's results to see if claims have leveled off at all.

8:30: U.S. – Philadelphia Fed Manufacturing Index: expected to have gone into freefall and slid to -30.0 from -12.7.

22:00: China – GDP: forecast to have dived to -6.0% from 6.0%.

22:00: China – Industrial Production: seen to have expanded to -7.0% from -13.5%.

Friday

5:00: Eurozone – CPI: expected to climb to 0.5% from 0.2% MoM, while keeping steady at 0.7% YoY.

Related Articles

We haven’t discussed global monetary inflation for a while, mainly because very little was happening and what was happening was having minimal effect on asset prices or economic...

Last week, we discussed the more extreme levels of bearishness that have gripped the markets as of late. “In other words, while the media scrambled to align reasons with the...

I’m sure this week will be interesting, given the CPI and PPI reports. I’m sure the administration will have plenty of on-again and off-again policy statements about something....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.