- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Watts Water (WTS) To Grow On Segmental Growth, Higher Volume

On Mar 12, we issued an updated research report on Watts Water Technologies, Inc. (NYSE:WTS) . This maker of water safety and flow control products is anticipated to benefit from projected sales growth across all segments, higher volume as well as focus on product innovation. Upbeat economic data and the U.S. tax reform also bode well for the company.

Let’s illustrate these growth factors in detail.

Segments Well Poised for Organic Sales Growth

In the Americas segment, Watts Water estimates revenues to be up organically in the range of 3-5% in 2018, with solid growth across most of its product lines. Furthermore, the company predicts organic sales growth in the range of 1-3% in Europe segment for the year. It expects improved performance in both fluid solutions and drainage product lines based on the upbeat end markets. In the Asia-Pacific segment, the company anticipates organic sales to grow between 7% and 10%, with strong growth both inside and outside of China in 2018.

Higher Volume to Boost Operating Margin

Watts Water estimates its consolidated operating margin to expand in the band of 50-70 basis points in 2018 driven by higher volume and continued productivity-increment efforts, including restructuring savings. The company continues to reinvest a portion of productivity savings in selling and marketing, R&D and IT systems to fund near-term growth. It also believes pricing actions taken in fourth-quarter 2017 should help to partly mitigate commodity inflation. Thus, the company’s further pricing actions and restructuring benefits will drive margin performance in 2018.

Watts Water to Gain From Product Innovation

Watts Water strives to invest in product innovation. Over the past couple of years, the company invested in sales and marketing, and R&D to roll out fresh products. It witnessed success in 2017 in underpenetrated regions, like Korea and Latin America, on the back of products like IntelliStation, SmartSense and Benchmark Platinum. These have originated from the company’s product-development initiatives which will stoke growth.

Tax Reform to Boost Earnings

Watts Water is expected to benefit from the tax reform in 2018. The company estimates that the effective tax rate will be roughly 28% for the year, about five percentage points lower than 2017. This will be accretive to earnings.

Upbeat Economic Data Signal Growth

Watts Water expects that the residential and non-residential markets in the Americas will improve year over year in 2018. Notably, low unemployment, a tight supply of existing homes for sale, builder sentiment and fairly consistent housing starts, indicate a steady residential market for the year. In the non-residential market, much of the forward-looking data, like the ABI and Dodge Momentum Indexes, are trending positively.

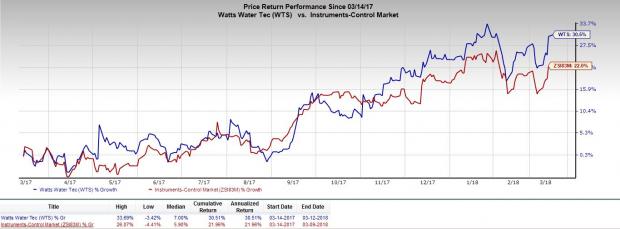

Share Price Performance

Watts Water has outperformed its industry with respect to price performance over the past year. The stock has appreciated around 31%, while the industry has recorded growth of 22% during the same time frame.

Zacks Rank & Other Stocks to Consider

Watts Water carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the same sector are Badger Meter, Inc. (NYSE:BMI) , Nanometrics Incorporated (NASDAQ:NANO) and Transcat, Inc. (NASDAQ:TRNS) . While Badger Meter sports a Zacks Rank #1 (Strong Buy), Nanometrics Incorporated and Transcat carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Badger Meter has a long-term earnings growth rate of 15.3%. Its shares have rallied 41.7%, over the past year.

Nanometrics Incorporated has a long-term earnings growth rate of 12%. The company’s shares have been up 4.4% during the same time frame.

Transcat has a long-term earnings growth rate of 8%. The stock has gained 20% in a year’s time.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Badger Meter, Inc. (BMI): Free Stock Analysis Report

Nanometrics Incorporated (NANO): Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS): Free Stock Analysis Report

Transcat, Inc. (TRNS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.