- Did you notice that Apple (AAPL) is down two days in a row while Nasdaq has been up? It would seem that those who are holding big lots of Apple are using the strength of the general market to unload, without causing panic. Rather, BOYZ may be pumping the market to distribute. There is a method in the madness my friends.

- Bad news is good news. US GDP is below estimate. UK in double dip recession. Spain is downgraded. US unemployment claim is high. How do we react? By pushing the stocks higher. How quickly the sentiment changes. Only last week there were talks of end of Bull Run and deep correction. Today we are talking of SPX 1500!

- SPX is on its way to re-test the high of April 2. My maximum upside target was/still is 1450 + or – a few points. We have already been to 1422 and back. I do not see the point of taking risk to go long for another 2% at this point.

- We may not hit a huge bear market anytime soon, but let us not rule out the possibility of a 10%-15% correction. The Chairman said that he will be there to catch us if we fall. Look at it other way. He can catch us only if we fall and he is standing ready to catch. If the market keep going up where is the need for cash, I mean to catch? Now that GDP count has come lower than expected, he can justify more easing without looking partisan. But for that he needs some panic. Mark my words, panic will come soon.

- Then why am I not doing anything? Because any action now will not result in good entry. If we shorted last week, we would have regretted already as you can see. And if we go long now, we will regret week after.

You are really interested in understanding how the macroeconomic factors and world events affect the market behavior in the USA. You read all finance blogs and are convinced that the world is run by bad bankers and politicians and it will soon come to an end. You have started hording gold because you believe gold will reach $10000/oz and fiat money will come to an end. But still, for the last four years, your portfolio may not have grown along with your conviction. How do I know? Because I am one of those suckers who fell for that trap.

Only now I am waking up to the reality. Only now I am starting to understand a little as how money of today is different from money of yesterday. What are the powers and limitations of CBs. Eyes are now opening to the fact that fear mongering is a powerful business model. I am not mocking anyone. I am just one of those who have been taken to the cleaners time and again and have now decided to try it out myself. This is a process of learning and in that process; I have made some good calls and some bad calls. I am trying to learn from the mistakes and bad calls and reduce bad calls. And I think I will reach there.

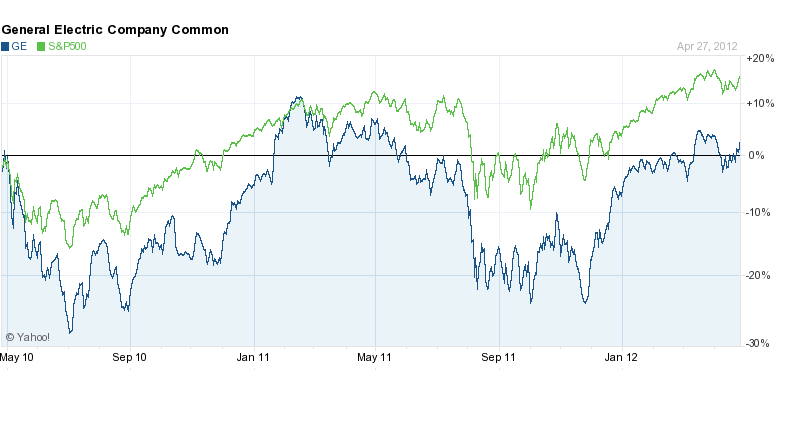

To make a long story short, if you want to know where the Index will go, just follow General Electric (GE).

This is a comparison of GE vs SPX. If you can analyze how GE will perform going forward, you may be able to guess where the markets will go.