Let’s back off of the day-to-day flow of headlines and look back five fiscal quarters: on July 11, 2011, the price of shares of Coffee Holding Co. (JVA) hit a short-lived peak, selling for $29.35. By August 8, 2011, the same shares closed at less than half of that. For a few days thereafter, though, a bounce seemed to be underway. Then, on August 30, according to an 8-K filing, JVA “became aware that there is certain information in the marketplace regarding its operating results,” so it filed preliminary sales data with the SEC. But the data was bad news. So: why the upward move in the three weeks before that filing?

The run-up came about because speculators speculated on other speculators. In the first half of 2011, 86 percent of JVA’s profits had come from its own gains in coffee options. It was an operating company attached to a prop desk, and the prop desk was doing quite well.

So speculative success made it a target of other speculators, long and short.

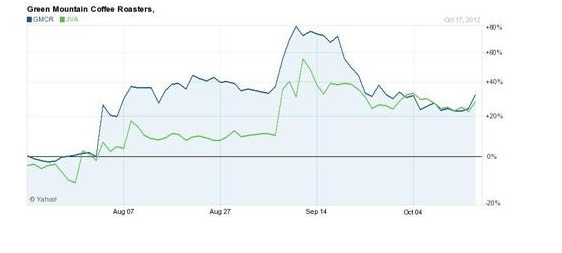

By this spring, 2012, it had become clear though that JVA had now tied its fate to that of Green Mountain, and the two have fallen and risen in concord.

Source: Seeking Alpha

Now, just a little more than a year after its close brush with the $30 mark, JVA is trading in a range between $6 and $8. The simple lesson: coffee, both as a commodity and as a market, is an extremely volatile market.

Different Challenges

People trying to run functioning commercial enterprises face challenges quite different from those of traders, and they see the markets differently. Rachel Hamburger, the chief executive of the large coffee roasting concern Portofino Coffee Ltd. (Israel), told me earlier this year that she is among those unhappy with the wild swings in the price of coffee beans. She attributes these swings in large part to speculative fevers, and in part to the continued use of the U.S. dollar as the world’s monetary numéraire, a standard that itself now whirls about in the winds.

I submit that if your interest is in investing in commercial enterprises, especially in equity thereof, and holding that investment for any length of time, you have to put yourself in the shoes of Ms. Hamburger and her counterparts.

Traders, on the other hand, aren’t disturbed by such zigzags. At least not in their professional capacity. It is all, for them, business as usual at the worst, and opportunity at best. Coffee and wheat are where, in the words of Jack Scoville, of the Price Futures Group, “there tend to be sharp run-ups and sell-offs” in contrast to “commodities used for feed, such as soybean or corn.”

Bring in the Accountants

Uncertainties affect the whole chain of production, from the planter in Colombia to your local Dunkin’ Donuts. What is worse than the usual agricultural commodity uncertainty, and its ripples along the chain of distribution to the ultimate consumer, though, is the way that accusations (or the reality of) accounting chicanery is often added to the mix. Forensic bean counters seem to pay attention to these more literal beans at irregular intervals.

Consider the year-long decline of the stock price of Green Mountain Coffee Roaster (GMCR). Like JVA, GMCR was once quite the high-roller. But for different reasons – it wasn’t the "prop desk." It was or seemed to be operational excellence that worked so well for GMCR when its stock was selling at above $100 a share in September 2011.

Nowadays it is zigzagging around $24 a share.

At least part of what happened in the meantime was that credible people called the accounting into question. In October, David Einhorn gave a detailed presentation on GMCR to the Value Investing Congress. He focused on one of GMCR’s so-called fulfillment entities, MBlock, a company that processed a majority of the sales for the company’s at-home single-cup operation with US based retailers.

The GMCR/MBlock relationship sounded to Einhorn too much like a convenient shuffling of corporate entities. Field research strengthened the impression that “Green Mountain and MBlock are potentially engaged in a variety of shenanigans that appear designed to mislead auditors and to inflate financial results.” Litigation about these potential shenanigans was already underway when Einhorn wrote those words, and it continues to this day.

Anyone can litigate anything in the courts of these United States, of course, and my point isn’t that GMCR has done anything illegal. It is that such allegations are of some weight in the eyes of credible observers, that they are for reasons not worth exploring here endemic in coffee, and that they must add to the volatility of the space.

All of this brings with it the further possibility of a lot of inefficiency, and of opportunities for uncovering alpha.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Waking Up To Volatility In Your Cup

Published 10/24/2012, 01:42 AM

Updated 07/09/2023, 06:31 AM

Waking Up To Volatility In Your Cup

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.