- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Verizon: 4.6% Yield, Decades Of Dividend Growth

Verizon Communications (NYSE:VZ) is one of the largest telecommunications companies in the world. The company currently has a market cap of $192.9 billion.

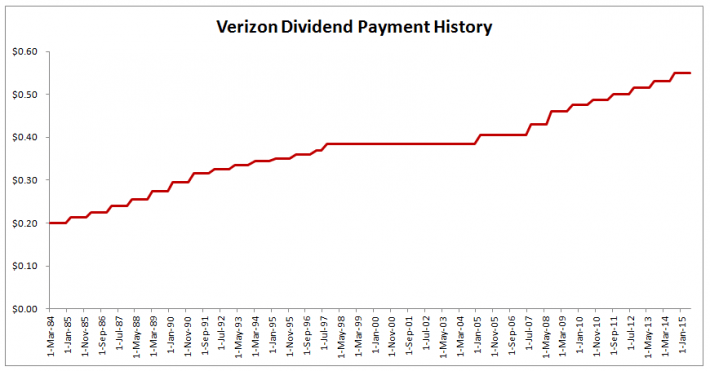

Prior to July 3, 2000, Verizon was known as Bell Atlantic. Including Bell Atlantic’s dividend history, Verizon has paid steady or increasing dividends since 1984.

Investors looking for stability should look no further than Verizon. The image below shows Verizon’s dividend history since 1984:

Verizon Wireless currently has a dividend yield of 4.6%. For comparison, the S&P 500 has a dividend yield of just 2.0%. Verizon’s dividend yield is 130% greater than the S&P 500’s.

This makes Verizon Wireless an ideal candidate for retired or soon-to-be retired investors seeking both stability and yield.

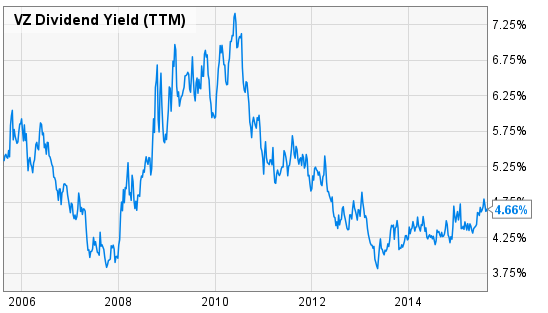

Verizon’s Yield History

Now is not ‘the perfect time’ to buy Verizon stock, but that doesn’t mean it is a bad time, either. The image below shows Verizon’s dividend yield fluctuations over the last decade:

The best time to buy Verizon was in 2010. At that time, the stock could be purchased at yields of 6% – and even briefly above 7%. Stock don’t become undervalued because everything is going well.

In 2010, Verizon’s dividend payments were very much in question. The company had a large debt load, and GAAP earnings had been reduced due to the Great Recession – which had reached its bottom only a year earlier. The company had a payout ratio over 200%.

As we all know now, Verizon did recover. The company continues to pay increasing dividends to this day.

Today, potential investors in Verizon no longer face the uncertainty investors in 2010 did. What makes Verizon appealing today is its high yield despite the current low rate environment.

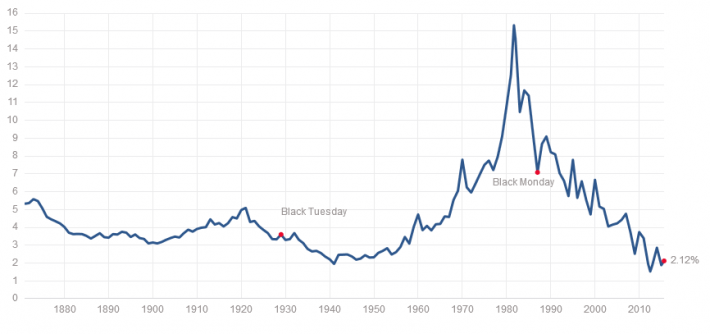

The image below shows the yield on the 10-year U.S. treasury bond, going as far back as the 19th century.

You can clearly see that we are a historically low yield environment. The 10-year treasury interest rate has only fallen since 2010. The only time in United States history that rivals today’s low rate environment is the early 1940’s – when rates were artificially reduced to support World War II spending.

Verizon still has such a high yield because management is committed to paying out the bulk of its profits as dividends. From 2005 through 2014, Verizon had an average payout ratio of 73% (using adjusted earnings).

While interest rates and yields have fallen in general, this is not the specific case with Verizon Wireless. In the year 2000, Verizon had a dividend yield of around 3%, and the interest rate on 10 year treasury bonds was 6%. Today, Verizon has a 4.6% dividend yield, while the 10 year treasury bond’s yield has fallen to 2.1%.

Recent Results & Total Returns

Verizon’s high yield is attractive in today’s low rate world relative to other investments. On top of this, the company posted solid results in its most recent quarter.

Earnings-per-share grew 14.3% (using adjusted earnings) versus the same quarter a year ago. Verizon’s CEO Lowell McAdam had this to say about the positive results:

“Verizon has delivered another quarter of strong financial and operational results, based on consistent network reliability and superior value that continues to attract new customers… In the second quarter, we again balanced quality Verizon Wireless connections growth with low churn and profitability, and we announced and completed our acquisition of AOL. We’re now poised to offer customers exciting new over-the-top (OTT) mobile video services, and we look forward to a very positive second half of 2015.”

Earnings-per-share growth was a result of the following:

- Comparable revenue grew 2.8%

- Wireless segment EBITDA margin increased from 42.3% to 43.9%

- Wireline segment EBITDA margin increased from 23.4% to 23.5%

- Diluted shares outstanding fell 1.6% due to share repurchases

Verizon’s margin gains in its wireless segment were the biggest driver of favorable growth in the company’s most recent quarter. The company realized its lowest wireless churn rate in 3 years of just 0.9%. Churn measures the percentage of customers who cancel their service in a given month.

Over the last decade, Verizon has compounded its earnings-per-share at 3.0% a year. Dividends have grown at 3.2% a year.

Verizon’s management is expecting revenue growth of around 3.0% a year going forward, in line with historical growth. With continued share repurchases, the company should be able to compound earnings-per-share at a rate of 4.0% a year, not accounting for additional margin improvements.

Verizon’s management has managed to realize faster earnings-per-share growth in recent years. If the company can continue to boost margins through efficiency gains, shareholders could see earnings-per-share growth of 7% to 8% a year.

Investors in Verizon should expect total returns of between 8.6% and 12.6% a year from dividends (4.6%) and earnings-per-share growth (4% to 8%).

Final Thoughts

The S&P 500 has offered investors compound total returns of around 9% a year over the long-run. Verizon Wireless’ expected total returns of 8.6% to 12.6% (10.6% on average) make it likely that investors in Verizon Wireless will outperform the market.

Despite offering higher expected total returns, Verizon Wireless has a price-to-earnings ratio of just 12.9 (using adjusted earnings). Compared with the S&P 500’s current price-to-earnings ratio of 20.7, Verizon Wireless appears undervalued.

In addition, the company is highly stable. Verizon’s 3 decade streak of stable or increasing dividends shows the company has reliably rewarded income investors. Verizon Wireless ranks in the top 30% of long-term dividend stocks using The 8 Rules of Dividend Investing thanks to its solid total return potential, low valuation, and stability.

Related Articles

The market for 3M (NYSE:MMM) stock is on fire, with shares rising by 7% in the final week of February and 65% in the preceding 12 months, and there is more upside ahead. The...

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.