- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

VeriSign (VRSN) Gains On Higher Q4 Domain Name Registrations

VeriSign’s (NASDAQ:VRSN) latest The Domain Name Industry Brief report stated that domain name registrations increased almost 2.4 million or 0.7% sequentially to 362.3 million across top-level domains (TLDs) at the end of the fourth quarter of 2019. Domain name registrations increased roughly 13 million or 13.9% year over year.

On a combined basis, .com and .net TLDs increased 3.9% year over year and 0.9% sequentially to approximately 158.8 million at the end of the fourth quarter of 2019. Verisign is the exclusive registrar of the .com, .net and .name domains per its agreements with The Internet Corporation for Assigned Names and Numbers (ICANN).

Notably, in the fourth quarter of 2019, revenues increased 1% from the year-ago quarter to $310.5 million. The company anticipates preliminary renewal rate to be 73.7%, down from 74.3% reported in the year-ago quarter.

Moreover, VeriSign released a proposed agreement with The Internet Corporation for Assigned Names and Numbers to amend the .COM Registry Agreement on Jan 6, 2020.

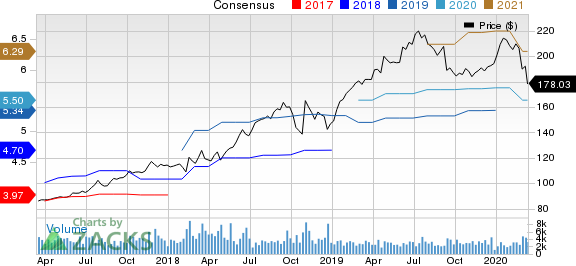

VeriSign, Inc. Price and Consensus

Proposed Terms of the Agreement

The agreement would allow Verisign to increase prices by 7% in each of the last four years of each six year contract renewal. This is in line with an agreement Verisign struck with the U.S. government to amend the Cooperative Agreement in 2018.

Additionally, the wholesale price of a .com domain has been proposed to increase from $7.85 to $10.26 over the next four years, and registrars will add their own mark up.

Notably, ICANN is not a price regulator and depends on the U.S. government for .com prices. The price increase from the current wholesale price of $7.85 to the maximum price of $10.26 in 2024 represents annual increase of $2.41.

New Registrations Details

As of Dec 31, 2019, the .com domain name base totaled approximately 145.4 million domain name registrations. The .net domain name base registrations totaled roughly 13.4 million. VeriSign reported that .com continued to maintain its position as the largest TLD, followed by .cn (China) and .tk (Tokelau).

New .com and .net registrations were 10.3 million compared with 9.5 million in the year-ago quarter.

New gTLD (“ngTLD”) registrations increased 22.2% sequentially and 23.2% year over year to 29.3 million. The top 10 ngTLDs represented 63.3% of all ngTLD domain name registrations.

As of Dec 31, 2019, there were 48 ngTLDs delegated that have a geographical focus and more than 1,000 domain name registrations since entering general availability (GA).

Details of Country Code Top-Level Domains

Country Code Top-Level Domains (“ccTLDs”) decreased 2.6% sequentially while the same increased 2.1% year over year to 157.6 million.

Excluding .tk, ccTLD domain name registrations decreased 3.1% sequentially and 0.2% year over year.

As of Dec 31, 2019, the top 10 ccTLDs were .tk (Tokelau), .cn (China), .de (Germany), .uk (United Kingdom), .nl (Netherlands), .ru (Russian Federation), .br (Brazil), .eu (European Union), .fr (France) and .it (Italy).

Moreover, there were 305 global ccTLD extensions delegated in the root zone including Internationalized Domain Names (IDNs), with the top 10 ccTLDs composing 65.6% of all ccTLD domain name registrations.

VeriSign’s Guidance for 2020

Domain Name Base is expected to increase between 2% and 4% from 2019-end to 2020-end.

Moreover, VeriSign expects full-year revenues between $1.250 billion and $1.265 billion.

Zacks Rank & Stocks to Consider

VeriSign currently has a Zacks Rank #3 (Hold).

Intel Corporation (NASDAQ:INTC) , Applied Materials, Inc. (NASDAQ:AMAT) and Garmin Ltd. (NASDAQ:GRMN) are some better-ranked stocks in the broader computer and technology sector. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Intel, Applied Materials and Garmin is currently pegged at 7.5%, 9.9% and 7.4%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Intel Corporation (INTC): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

VeriSign, Inc. (VRSN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.