- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Value Stock Funds Are Lacking Value

Procter & Gamble (NYSE:PG) is a conservative and highly regarded consumer staples company with a 180-year track record. The company produces many globally admired consumer brands, some of which we share below.

Does being a great company with financially conservative values make PG a value stock? It is tempting to answer yes, as most large-cap value stock funds hold a sizeable stake in PG.

PG trades at key valuation ratios (P/E, P/B, and P/S) greater than the S&P 500. PG’s annualized revenue and earnings growth rates are 3.7% and 4.3%, respectively, over the last five years. Over the same period, the S&P 500 Index has grown revenue and earnings at more than double PG’s rate.

Per the gurus of value, Benjamin Graham and David Dodd, a stock should have good prospects and low valuations ratios to be classified as value. They believed investors should buy stocks with undervalued assets and that those assets, in time, would appreciate to fair value.

PG has overvalued assets and weaker than market growth prospects. Why then is PG considered a value stock by most investors and a top ten holding in many value funds?

As we will show you, the term value has been grossly misapplied in recent years.

Whether or not PG is a value stock is irrelevant. What is relevant is whether “value investors” using value stock mutual funds and ETFs own what they think they are buying.

Passive Investing Distorts Value

In 2016, we wrote Passive Negligence, the first in a series of articles comparing active and passive investment management styles and the effects passive investing has on markets.

Per the article:

“Passive index strategies are all the rage. Investors desperate for “acceptable” returns are investing in funds whose value is directly linked to stock market indices. Unlike active funds, indexed funds do not perform investment analysis and are not looking for sectors or companies that offer greater return potential than the market. They do one thing, and that is replicate a particular equity index.”

True active investors seek individual stocks that meet qualifications they deem as valuable.

Passive investors rely on indexes, funds, and ETFs to do the research for them. We offer caution to these investors who only check to see whether the word “value” is in a fund’s name.

The Vanguard Value Stock Index Fund Admiral Fund

Let’s delve into one of the largest value funds as a proxy for how large funds define value.

Per Vanguard, Vanguard Value Index Fund Admiral Shares (VVIAX) “invests in stocks of large U.S. companies in market sectors that tend to grow at a slower pace than the broad market; these stocks may be temporarily undervalued by investors.”

The fund is massive, with an aum of over $140 billion. VVIAX is likely the only large-cap value option for quite a few 401k plan participants.

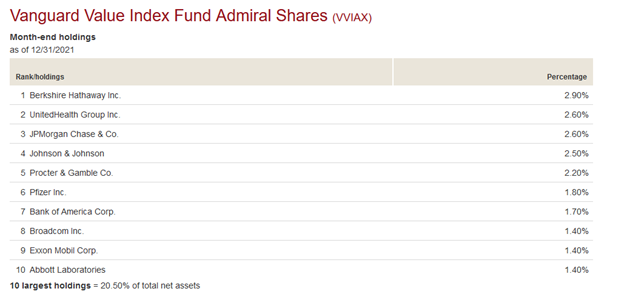

The table below from Vanguard shows the fund’s top ten holdings, accounting for about a fifth of the fund. We examine these ten stocks and judge if they are genuinely value stocks.

Does Vanguard Value Index Fund Have Value Stocks or Value Companies?

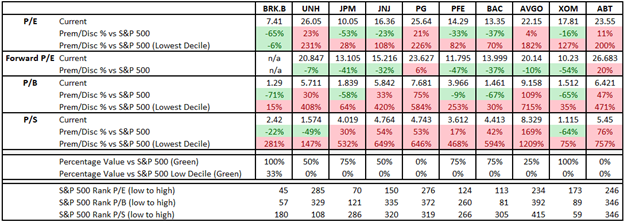

The table below compares four key valuation ratios (P/E, Forward P/E, P/B, and P/S) of the top ten VVIAX holdings versus the S&P 500 and against the lowest decile for each valuation metric within the S&P 500.

If VVIAX truly holds value stocks, its holdings should have valuations that are cheaper than the market and, in many cases, should be among the cheapest decile of the market. We use green shading to signify if each company’s valuation is below the S&P 500 or the average of the lowest decile per metric.

Below the four valuation models, we show the percentage of each company’s valuations below the market and the lowest decile.

Lastly, we rank each of the ten holdings against every S&P 500 stock based on their respective P/E, P/B, and P/S. The lower the rank, the more relative value versus the other S&P 500 constituents.

Of the ten companies and three valuation techniques we have the lowest decile data for, only one instance is green. Berkshire Hathaway (NYSE:BRKa) trades at a P/E below the average of the lowest decile.

The rankings highlight that most valuations are in the middle of the pack versus S&P 500 companies.

Vanguard’s holdings may be considered value companies, but other than Berkshire and maybe Exxon (NYSE:XOM), it’s hard to make the case that its top holdings are value stocks.

Picking on PG

We revisit PG to show its valuations are far from what we should expect from a value stock. As shown in the table above, PG’s valuations are at a premium to the market. Further, all three of its rankings are above the median of the S&P 500. Also note, every square on the table is red for PG!

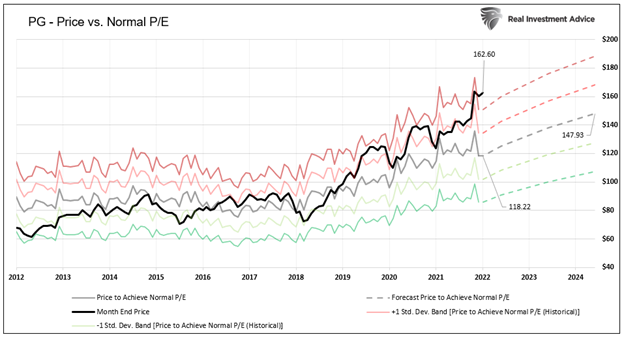

We use an internal model to help assess value and analyze how PG trades versus what we deem fair value. The graph below, from our model, plots PG’s price (black) and where the price would be based on its normalized price to earnings (P/E) ratio (gray). The gray line signifies the fair value price if PG traded at its average 10-year P/E of 21.29. The red and green lines highlight one and two standard deviations from the average. Green is cheap and red expensive versus fair valuations.

PG at ($162.60 per share) is trading over two standard deviations above its fair value price of $118.22. Even using two years forward earnings forecasts in the P/E ratio, the stock is trading about 10% above fair value ($162.60 vs. $147.93). Before 2019, PG traded at or below the normalized P/E fair value.

To further drill home our point, our Price to Sales model (P/S) puts PG’s valuation at over 50% above fair value. Additionally, Zacks Investments values PG at 41.4% above its model’s fair value.

PG may be a great company, but it’s certainly not a value stock.

What Value Looks Like

Mosaic Company (NYSE:MOS) is the nation’s largest potash and phosphate fertilizer producer. Its stock trades at a P/E of 7.6, P/B of 1.3, and a P/S of 1.2. Over the last five years, its revenue has grown at 9%, and its EBITDA has increased by over 15%. Zacks forecasts 7% sales growth going forward. MOS is not a household name, nor does it have consistent earnings or a nearly 200-year history. However, MOS is trading at a far cheaper valuation than PG.

We are not recommending MOS. We summarize MOS to contrast a value stock from a value company. Keep in mind not all value stocks are worth buying either. For instance, MOS may have flaws and risks accounting for its cheap valuation. We might call MOS a value trap if is flawed or overly risky.

The Road Ahead

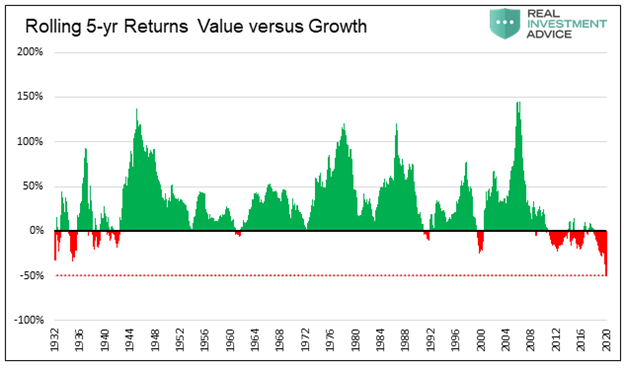

The graph below from The Future Promise of Value Versus the Allure of Growth, shows that value tends to outperform growth; however, growth has significantly outperformed value over the last ten years.

Suppose recent rotations toward value stocks are an indication that we are in the initial stages of a longer-term rotation to value from growth. In that case, we suspect the sizeable passive value stock funds will attract money from other passive funds. If true, these value funds could outperform in the short run. However, if the value trade persists and if markets trade poorly, passive investors may not get the results they are planning for as even passive sellers will move to cash or fixed-income products to shelter wealth.

Most deep discount, smaller, and underfollowed value stocks are not well represented in passive funds. Therefore, they are not subject to selling by passive investors. Accordingly, we suspect that if the market is weak and passive “value” investors get jittery actual value stocks will have their day in the sun.

Summary

PG is a value company but not a value stock. Value investors should prefer value stocks, not necessarily value companies. The takeaway based on Vanguard’s VVIAX fund: most investors are not getting value stocks in value ETFs and mutual funds.

Many value stocks are poorly represented in passive funds. As such, they are less likely to move with markets. This can be a problem if stocks continue rising to record valuations. It can be a blessing if valuations normalize.

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.