- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Vale May Idle Malaysia Iron Ore Terminal, Q1 Sales Impact Likely

Vale S.A (NYSE:VALE) announced it may suspend iron ore shipments to its Malaysian terminal and distribution center, Teluk Rubiah Maritime Terminal (TRMT), starting Mar 21, which would lead to 800,000 tons in lost shipments over the first quarter.

The terminal shipped 23.7 Mt of iron ore in 2019. Vessels heading to TRMT will be redirected and redistributed among its blending facilities in China. While there is no expected impact on production and sales volume in 2020, the idling of the terminal till Mar 31, 2020 is likely to impact sales of approximately 800,000 tons in first-quarter 2020. Additional logistics are likely to lead to an increase in costs; however, it will be immaterial to margins.

Malaysia has a total of 553 coronavirus cases, per the situation report by the World Health Organization. The country has now closed its borders to the outside world and imposed a two-week lockdown to contain the spread of the coronavirus. The extent of the outbreak will determine whether the lockdown needs to be extended. Vale continues to take steps and policies to safeguard its employees, businesses and communities surrounding operations from the coronavirus-induced crisis.

Vale had earlier announced that it is placing its Voisey's Bay mining operation in Canada on “care and maintenance” for a period of four weeks. The move is a precaution measure to help protect the health and well-being of Nunatsiavut and Innu indigenous communities in Labrador, and its own staff due the fly-in nature and higher exposure to travel of the remote mining operation. Voisey's Bay produced 25.0kt of copper in concentrate in 2019. The decision also impacts Voisey's Bay Mine Expansion project currently underway to transition to underground operations.

Vale also informed that due to travel and equipment transportation restrictions, it is revisiting its plans for the Mozambique coal processing plants stoppage. Notably, it was previously expected to commence operations in second-quarter 2020. A new date is under evaluation, which could ultimately affect coal production guidance for 2020.

The virus has claimed thousands of lives globally and become a major threat to public health worldwide. Both commodity and stock markets are bearing the brunt of the outbreak with disruption of global supply chain, businesses shutting down in China, the United States and Europe. Mining companies are halting their operations as different governments are imposing restrictions to combat the spread of the coronavirus.

The Peruvian Government for instance, has closed its borders, declaring a state of national emergency requiring a 15-day quarantine. In the wake of this, Pan American Silver Corporation (NASDAQ:PAAS) , Newmont Goldcorp Corporation (NYSE:NEM) and Freeport-McMoRan have announced temporary suspension or ramping down of mining operations in the country. Neighboring country Chile declared a 90-day state of catastrophe, restricting freedom of movement. Teck Resources announced the suspension for an initial two-week period of construction activities at its Quebrada Blanca Phase 2 (QB2) project.

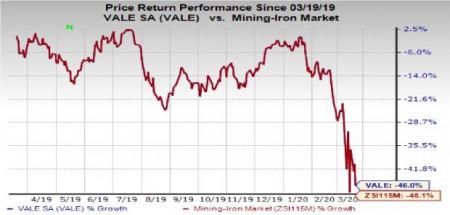

Price Performance

Vale’s shares have declined 46% in the past year in line with the industry.

Zacks Rank & Another Stock to Consider

Vale currently carries a Zacks Rank #2 (Buy).

Another top-ranked stock in the basic materials space is Franco-Nevada Corporation (TSX:FNV) which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has an expected earnings growth rate of 24.2% for 2020. Its shares have returned 37.5% in the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

VALE S.A. (VALE): Free Stock Analysis Report

Newmont Goldcorp Corporation (NEM): Free Stock Analysis Report

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

Pan American Silver Corp. (PAAS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.