- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

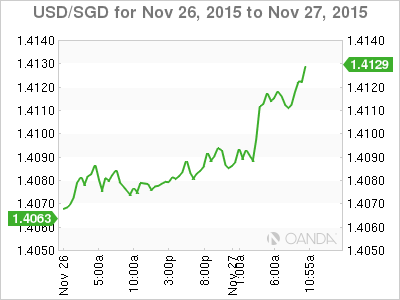

USD/SGD – Singapore Dollar Steady at 1.41

USD/SGD has posted slight gains on Friday, as the pair trades slightly above the 1.41 line in the European session. With no US or Singapore releases on the schedule, it could be an uneventful day for the Sing as we wrap up the trading week.

The Singapore dollar has flexed some muscle in the past 10 days, gaining around 150 points in that period. Earlier this week, Sing was buoyed by an excellent Singapore GDP reading of a 1.9% gain in the third quarter. This easily beat the estimate of 0.3% and was a sharp improvement from the Q2 reading of -2.6%. The news was not as positive from Singapore CPI, the primary gauge of inflation, posted a decline of 0.6% in October, a near repeat of the 0.5% decline a month earlier.

There were a host of US events on Wednesday, and the key releases played to mixed reviews. Unemployment Claims plunged to 260 thousand, well off the estimate of 273 thousand. There was more good news from Core Durable Goods, which rebounded with a strong gain of 0.5%, matching the forecast. UoM Consumer Sentiment improved to 91.3 points, but the markets were overly optimistic, as the estimate stood at 93.2 points. This consumer confidence indicator comes on the heels of CB Consumer Confidence, which dropped to 90.4 points, nowhere close to the estimate of 99.3 points. These weak consumer confidence readings could raise concerns, as soft consumer confidence numbers could translate into weaker consumer spending, which is a key driver of economic growth.

The guessing game continues regarding a December rate hike from the Federal Reserve, but most analysts feel that the long-awaited move will indeed occur next month. The Fed hinted at a rate hike in its October policy statement, and the markets have been abuzz ever since. Last week, New York Fed President William Dudley said there is a “strong case” for a rate hike in December as long as economic data remains strong. With the US economy looking solid and employment and consumer indicators pointing upwards, the markets appear prepared for some monetary tightening with small, incremental hikes. One fly in the ointment is that of weak inflation levels, as the Fed has repeatedly stated that inflation is a key consideration in any decision to raise rates. With the critical Fed meeting only a few weeks away, every key indicator and comment from a Fed member will be under close scrutiny from the markets.

USD/SGD Fundamentals

- There are no US or Singapore releases on Friday

USD/SGD for Friday, November 27, 2015

USD/SGD November 27 at 12:30 GMT

USD/SGD 140.78 H: 141.22 L: 140.65

USD/SGD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3810 | 1.3937 | 1.4073 | 1.4139 | 1.4248 | 1.4300 |

- USD/SGD was flat in the Asian session, and has posted slight gains in the European session.

- 1.4139 is an immediate resistance line.

- 1.4073 continues to be tested and is a weak support line.

- Current range: 1.4073 to 1.4139

Further levels in both directions:

- Below: 1.4073, 1.3937 and 1.3810

- Above: 1.4139, 1.4248, 1.4300 and 1.4395

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

Today marks a further large step into Donald Trump's America First Agenda. Substantial tariffs are being imposed on Canada and Mexico. Additional tariffs have gone in on China....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.