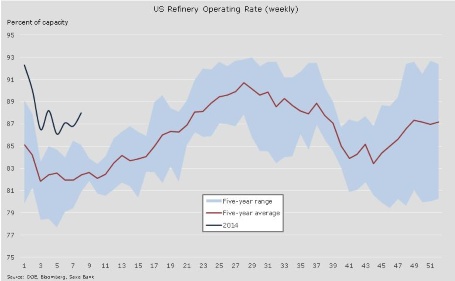

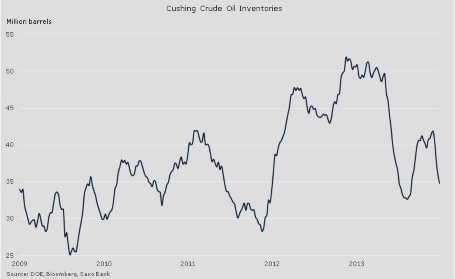

The weekly US inventory report from the Energy Information Administration is due today at 15:30 GMT. In it, traders will be looking out for signs of whether refinery demand has begun to ease as the country moves away from the winter season. A reduction in refinery demand could potentially have a negative impact on WTI crude due to the expected impact on inventories. Those trading the spread between WTI and Brent crude will be particularly interested to see whether inventory levels at Cushing continue to drop, thereby lending support to the ongoing contraction of the discount to Brent crude.

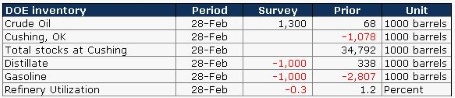

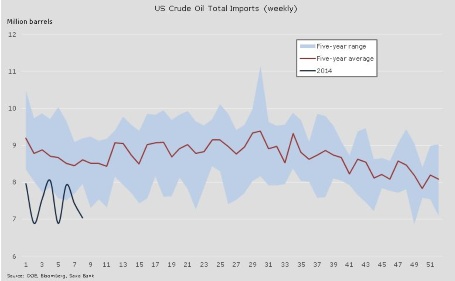

Despite having seen US crude inventories staying relatively high compared with the five-year average, the price of WTI crude has nevertheless stayed well supported during the past couple of months.

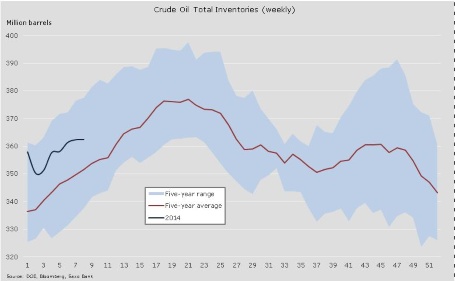

The US has experienced a very cold winter which has raised the demand for distillate products, such as heating oil.

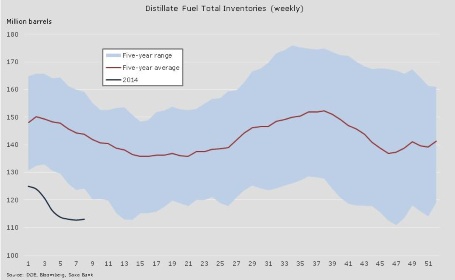

As a result of this, refineries have been operating at a much higher rate than usual. This has so far delayed the annual maintenance season when demand drops as production is being turned around towards the production of gasoline.

Higher refinery demand and improved pipeline infrastructure from Cushing, Oklahoma, have resulted in a sharp reduction in inventories at this former bottleneck. Together with a general strong demand this winter this has helped reduce the discount to Brent crude.

The improved flow of domestic-produced crude oil to refineries in the Gulf of Mexico area has also helped further reduce the need for imported oil. Currently, imports are running well below the five-year range and each barrel less needed by the US is one more barrel for the rest of the world. This is helping global oil markets to become more resistant to minor supply disruptions such as the current total of more than 3 million barrels per day from countries like Iran, Libya, Nigeria, Sudan etc.

Finally, here are the current expectations for today's inventory report as compiled by Bloomberg: