- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

US Government Reaches Deal On Stimulus Package: 5 Top Picks

In an unprecedented move to boost the U.S. economy amid the coronavirus-induced crisis, the U.S. government and the Senate finally reached an agreement on a massive stimulus package. The deal was reached early on Wednesday. Notably, the White House and the Senate had failed to reach a consensus two times previously this week.

On Mar 24, Wall Street reacted with enthusiasm as market participants expected the deal to come to fruition. Consequently, the Dow rallied 2,112.98 points or 11.37% — its biggest single-day gain after 1933. Moreover, percentage-wise, yesterday's rally was the fifth-best in the blue-chip index's history.

Meanwhile, the market's benchmark — the S&P 500 — jumped 209.93 points or 9.38%. This marked the broad-market index's best single-day rally after October 2008. The tech-laden Nasdaq Composite also advanced 557.18 points or 8.12% — its best day since Mar 13.

Unprecedented Fiscal Stimulus

In the first hour of Mar 25, the U.S. government and Senate lawmakers reached an agreement to inject $2 trillion of stimulus to boost the U.S. economy amid the coronavirus-induced turmoil. The package will include $250 billion for direct payments to individuals, $367 billion for loans to small businesses, $250 billion in unemployment insurance benefits and $500 billion in loans for distressed companies. Per the deal, hospitals would receive around $150 billion.

Per the stimulus package, most adults would receive direct payments of $1,200, married couples would get $2,400 while children would get $500 in checks. Loans given to small businesses may be waived if the companies don’t make any changes to payroll.

Fed Injects Huge Monetary Stimulus

On Mar 23, Fed chairman Jerome Powell announced that the central bank will buy assets “in the amounts needed” to ensure smooth market functioning and effective transmission of monetary policy. Earlier, the Fed limited the asset purchase program by $700 billion — $500 billion in Treasury securities and $200 billion in mortgage-backed securities. Further, the central bank also unveiled a new lending program worth $300 billion.

Earlier this month, the Fed lowered the benchmark lending rate by 1.5% in two tranches, which reduced the Fed fund rate to 0-0.25%. Moreover, the central bank reduced reserve requirement for banks to zero and lowered the price of U.S. dollar swap arrangements in collaboration with five other central banks.

Our Top Picks

Wall Street's rally of Mar 24, however, doesn’t ensure the bottoming out of the market or the beginning of recovery, especially when coronavirus-induced crisis continues to ravage the global and U.S. economy. Nevertheless, unprecedented fiscal and monetary stimulus will definitely enhance the moral of market participants. This, in turn, will aid investors reap rewards in the long term.

At this stage, investment in large-cap stocks that have established business model and strong brand name with favorable Zacks Rank will be prudent. We narrowed down our search to five such stocks each of which are member of any of the three major stock index's and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

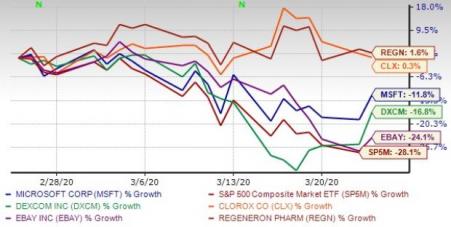

The chart below shows the price performance of our five picks in the past month.

Microsoft Corp. (NASDAQ:MSFT) is one of the largest broad-based technology providers in the world. The company dominates the PC software market with more than 80% of market share for operating systems.

Microsoft has an expected earnings growth rate of 18.1% for the current year (ending June 2020) and 12.8% for the next year. The Zacks Consensus Estimate for the current year has declined 0.5% but improved 0.2% for the next year over the past 30 days. The stock plunged 28.7% from its 52-week high.

Regeneron Pharmaceuticals Inc. (NASDAQ:REGN) is a biopharmaceutical company focused on the discovery, development and commercialization of treatments targeting serious medical conditions. The company’s portfolio boasts of marketed drugs like Eylea, Dupixent and Praluent.

Regeneron has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for the current year has improved by 3.2% over the past 30 days. The stock tumbled 13.2% from its 52-week high.

The Clorox Co. (NYSE:CLX) manufactures and markets consumer and professional products worldwide. The company operates through four segments: Cleaning, Household, Lifestyle and International. It sells products primarily through mass merchandisers, grocery stores and other retail outlets.

Clorox has an expected earnings growth rate of 1.6% for the current year (ending June 2020) and 5.3% for the next year. The Zacks Consensus Estimate for the current and next year has improved by 3.7% and 4.6%, respectively, over the past 30 days. The stock plummeted 21.4% from its 52-week high.

DexCom Inc. (NASDAQ:DXCM) is focused on the design, development and commercialization of continuous glucose monitoring systems in the United States and internationally. It offers its systems for use by people with diabetes and healthcare providers.

DexCom has an expected earnings growth rate of 22.3% for the current year. The Zacks Consensus Estimate for the current year has improved by 3.2% over the past 30 days. The stock slumped 23% from its 52-week high.

eBay Inc. (NASDAQ:EBAY) is one of the largest online retailers in the world. It operates the marketplace and classifieds platforms that connect buyers and sellers worldwide. Its platforms enable users to list, buy, sell and pay for items through various online, mobile and offline channels.

eBay has an expected earnings growth rate of 8.5% for the current year. The Zacks Consensus Estimate for the current year has improved by 0.3% over the past 30 days. The stock plunged 51.8% from its 52-week high.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

DexCom, Inc. (DXCM): Free Stock Analysis Report

The Clorox Company (CLX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.