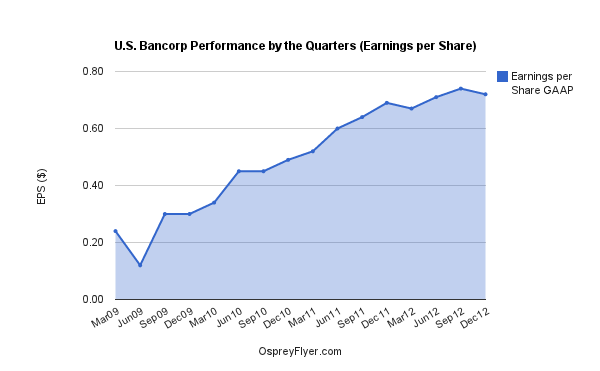

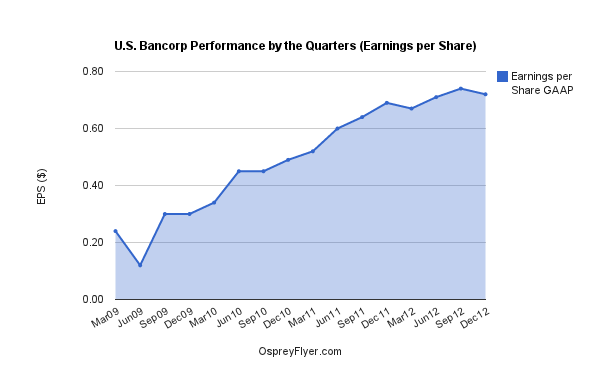

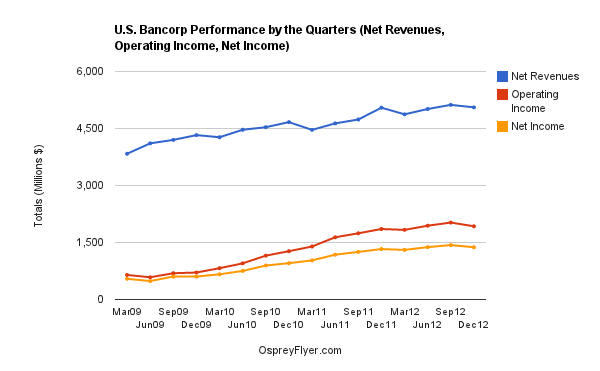

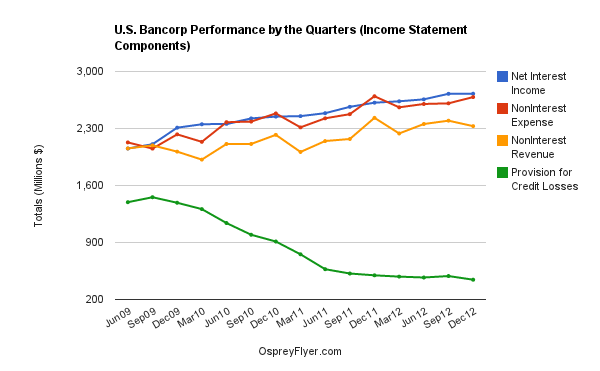

US Bancorp (USB) earnings continue at excellent performance levels as CEO Richard Davis posts quarter after quarter of maximized profits in a difficult macroeconomic environment. In fact, 2012 was a record year. This quarter, Davis was able to maintain earnings per share, net revenues, operating income, net income, operating margin, net margin, and return on assets near last quarter’s record levels. US Bancorp remains on top as the very best larger USA bank.

Diminishing returns is the uphill climb for US Bancorp. CEO Davis, through stellar performance, may have reached the summit of efficient profits. However, CEO Davis has proven me wrong in previous quarters so do not count US Bancorp out yet. There is only so high financial institution performance can reach without expansion or acquisitions. Risk management has proven excellent. Financial position and capital are very strong.

At QE 12-31-12 I have rated US Bancorp an “A” on a scale of A+ to G-. This is no change in the rating from the prior QE 9-30-12. The median rating is “D” and the average rating at QE 9-30-12 was “C”. Financial position strength is weighted more than financial performance. The QE 9-30-12 bank ratings review is here.

U.S. Bancorp Chairman, President and Chief Executive Officer Richard K. Davis said, “2012 was a great year for our Company, as we achieved record annual earnings of $5.6 billion, or $2.84 per diluted common share. Further, our 2012 full year results included record total net revenue of $20.3 billion, representing growth in net interest income and fee revenues, as well as controlled expenses. Additionally, we achieved positive operating leverage for both the year-over-year quarter and full year. Our returns on average assets and average common equity for 2012 of 1.65 percent and 16.2 percent, as well as our efficiency ratio of 51.5 percent, surpassed our performance in 2011 and remain industry leading.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Bancorp Earnings Review: Peaking Performance?

Published 01/17/2013, 05:58 PM

Updated 07/09/2023, 06:31 AM

US Bancorp Earnings Review: Peaking Performance?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.