- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

UBS Group AG (UBS) Raised Bonus Pool By 6% Y/Y To CHF 3.1B

UBS Group AG (NYSE:UBS) raised its bonus pool by 6% on a year-over-year basis to CHF 3.1 billion for 2017 ($3.3 billion), according to the Swiss banking giant’s annual report released last Friday. The total performance award pool for the Group Executive Board (GEB), including the Group CEO, was CHF 74.2 million for 2017.

The base salaries for the GEB and Group CEO, Sergio P. Ermotti, remained unchanged year over year. However, Ermotti’s total compensation for 2017 increased 3.6% year over year to CHF 14.2 million ($14.9 million), including CHF 11.4 million as variable compensation.

The report mentioned that the bonus pool has been determined on the basis of several performance metrics, including risk-adjusted profitability and capital strength. In awarding Ermotti’s pay, UBS stated that “overall performance exceeded plan despite significant market headwinds, including low market volatility, negative interest rate environment and high funding costs.” “We delivered excellent financial results, maintained our strong capital position and achieved our net cost reduction target in 2017,” the bank noted in the report.

Despite the low market volatility amid several global macro headwinds and excluding the impact of the U.S. tax reform, UBS witnessed a whopping 23.3% year-over-year rise in net profit to CHF 5.3 billion in 2017, benefiting from higher revenues, along with a substantial fall in litigation provisions.

Focusing on expense management, the company achieved annualized net cost-reduction target of CHF 2.1 billion.

Adjusted return on tangible equity of 14.1% surpassed the company’s target of 10%. On a fully-applied basis, UBS’ common equity tier (CET) 1 ratio remained stable at 13.8% in 2017, exceeding the 2017 target ratio of 13.0%.

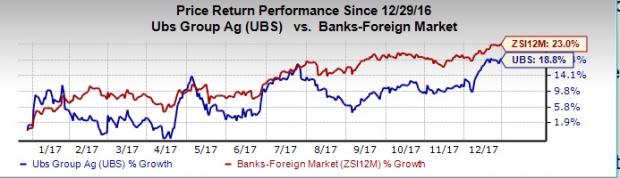

All positive factors have caused investors to become optimistic about UBS Group AG's long-term prospects. Notably, the company's share price appreciated roughly 18.8% in 2017 on the NYSE, compared with around 23% growth registered by the industry, following nearly 22.3% decline in 2016.

Other European banking behemoths — Credit Suisse (SIX:CSGN) Group AG (NYSE:CS) and Deutsche Bank AG (NYSE:DB) — both have increased bonuses for 2017.

Currently, UBS carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other foreign banks, KB Financial Group Inc (NYSE:KB) has been witnessing upward estimate revisions for the past 30 days. In six months’ time, the company’s share price has been up more than 27%. It carries a Zacks Rank of 2 (Buy).

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Credit Suisse Group (CS): Free Stock Analysis Report

UBS Group AG (UBS): Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB): Free Stock Analysis Report

KB Financial Group Inc (KB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.