Even though most analysts and economists had predicted that the Federal Reserve would move to reduce its monthly bond buying programme at its latest Federal Open Market Committee meeting, the central bank, as we had expected, refrained from doing so. Chairman Bernanke said, "Conditions in the job market today are still far from what all of us would like to see" and, "the committee has concern that rapid tightening of financial conditions in recent months would have the affect of slowing growth." Compass has expressed the same concerns over the past quarter in support of its view that tapering would not occur in September or, in fact, any time this year.

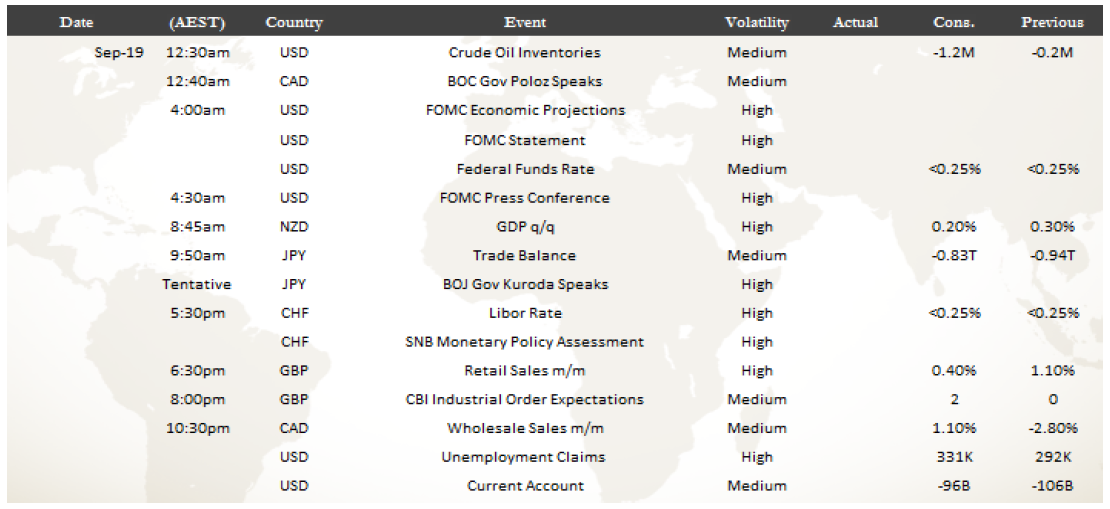

Most of the policy makers on the Federal Reserve have predicted that the first increase in interest rates in the United States will happened sometime in 2015. The five governors on the Federal Reserve's board and the twelve reserve bank presidents predicted that the federal funds rate target will be at 2% at the end of 2016. This is in comparison to a target rate of 4% at a time of full employment and stable economic conditions. The forecasts underline the absence of any strong optimism for the U.S. economy over the next two years and reflects the caution that the Federal Reserve has displayed by not tapering stimulus at its current meeting.

U.S. equity markets surged to record highs after the unexpected decision by the Federal Reserve to refrain from reducing its bond buying programme. The S&P 500 soared above the previous record high seen on August 2 after closing 1.22% higher at 1,725.52. A fall in the U.S. dollar,and a surge in riskier currencies such as the Australian dollar, should be short lived as the Fed's decision should be viewed as a reflection of the fact that not all is well with the U.S. economy. The rally in most asset classes in response to the Fed's decision is, for us, an excellent opportunity to sell. Earlier in Europe, bourses were mixed with the DAX higher by 0.45% while the FTSE lost 0.17%.

Commodity prices surges on the unexpected decision by the Federal Reserve to keep the stimulus tap at free flow. The Rogers International Total Return Index surged more than 1.4%. WTI crude recording its strongest gains in almost a month as it rose 2.69% to $108.25. Precious metals, as we had expected, we are big winner because of the Fed's decision to not yet taper. Gold surged 4.1% to $1,363 while silver rocketed 5.5% higher to $23.00. Copper soared 3%. Agricultural commodity prices also gained.