- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Trump, Resources And An ASX Market Rally

The U.S. election result has thrown another Brexit event at the markets and once again the markets have done and are doing the opposite of what many experts predicted. I did not focus on the U.S, election in too much detail and expected any post election rally or sell-off to be short-lived. However just as the sky never fell when voters in the U.K. decided to leave the European Union it’s has remained in place after the surprising win by Donald Trump. The biggest surprise though is that the so called “Trump Rally” keeps on going and so far, the Australian stock market seems to be following the lead and since early November has staged a fairly strong rally also.

I guess the prevailing wisdom is that the Australian stock market is riding higher mainly on the back of the so-called Trump rally, although higher commodities prices have also helped and lifted the fortunes of mining stocks like BHP Billiton (LON:BLT) and Rio Tinto (LON:RIO). Of course in reality there are many factors that drive markets higher or lower but for now the trend is certainly upwards.

S&P/ASX 200 Index – 1 Year Chart (December 2016)

In regards to the ASX 200/All Ords the questions for now is will the rally keep going until the end of the year or has the rally been overdone? Looking at the chart above it seems the market is primed for a pull-back towards 5200. I say this for two main reasons; firstly because the Australian economy is not in great shape and is still struggling to deal with the end of the mining boom. This means fundamentally speaking, I wonder why the market has rallied at all. Secondly, it’s almost become a routine now that the Australian stock market heads towards a multi-week high and then falls back again. It just can’t seem to keep a rally going.

One bright spot has been that some of the resources related stocks have done quite well this year with BHP Billiton being a good example.

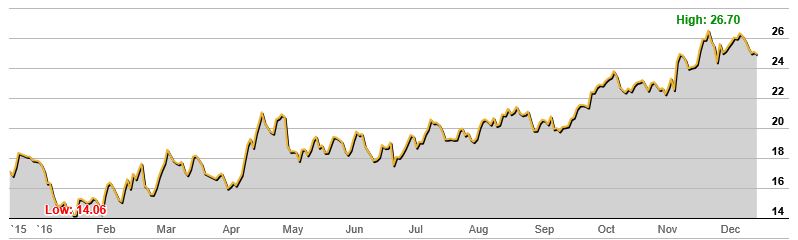

BHP Billiton Ltd (AX:BHP) 1 Year Stock Price Chart (December 2016)

I have focused on BHP shares quite a bit over the years since it really does sum up the state of the resources/hard commodities sector fairly well. BHP shares were smashed as the commodities bubble deflated, but this year it has staged quite a recovery and the share price is up from a low earlier in the year by just over 85%. Of course it’s easy to spot the low in hindsight but I did suggest this was a stock to worth watching back in October 2015.

My guess is that the hard commodities sector will recover over the next few years and probably the worst is over for the big diversified players. Of course stock prices may and will probably fall at times, but it’s a sector I reckon that’s well worth having exposure too.

Now for a stock that has not has a good year – Telstra

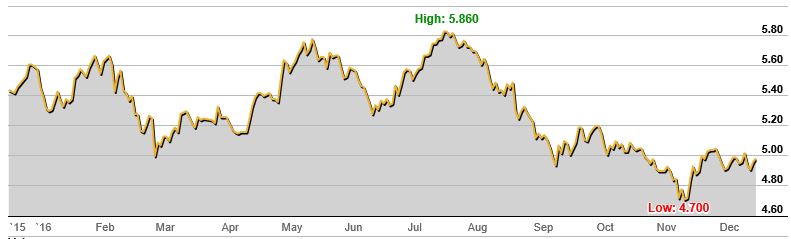

Telstra Corporation Ltd. (AX:TLS) 1 Year Chart (December 2016)

Telstra (TLS) used to be a reliable blue-chip stock that you could own and almost forgot about. Every now and then a dividend would arrive and you would be reminded it was in your portfolio. But this year it’s been on a bumpy ride and it’s now back down to a price which for me, makes it interesting again mainly because of the fully franked dividend it pays. The problem with Telstra though is that the management often seem to find novel ways to destroy shareholder value and so it’s a blue chip stock I am generally wary of.

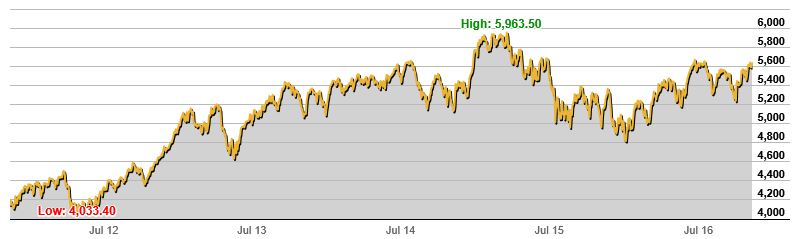

Finally a quick look back at the ASX All Ordinaries Index just to keep everything in perspective. The chart below covers the last five years and as I have written before, not a lot has changed over the last few years.

ASX All Ordinaries 5 year chart (December 2016)

The All Ords Index (XAO) is around levels today pretty similar to where it was back in mid 2013. It has been unable to post another strong rally as it did back when it hit a low near 4,000 and has been drifting along ever since. It may finish the year on a high, but I doubt either the All Ords or ASX will finish 2016 on a multi-year high. Maybe that’s something we can look forward to next year?

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.