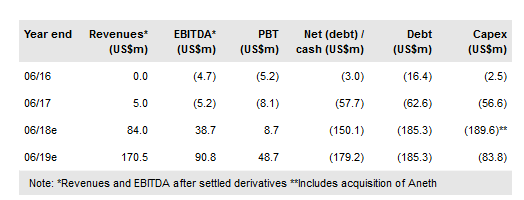

Elk Petroleum Ltd (AX:ELK)has completed a period of material inorganic growth with the acquisition of equity in the Madden gas field and assumption of operatorship at the Aneth CO2 enhanced oil recovery (EOR) project. ELK’s engineering review of Aneth has uncovered numerous near-term development opportunities that offer IRRs ranging from 22% to 87% at US$60/bbl WTI, at an average cost of US$6.8/boe. Projects are low technical risk asset enhancements, however, contingent on ELK’s re-financing expected in H2 CY18. ELK’s partner in Aneth, Navajo Nation Oil and Gas company (NNOGC), gained access to a US$80m debt facility in June 2018 to fund its share of Aneth development capex. Our risked valuation increases from A$0.12 per share to A$0.19 per share (61%) driven by the inclusion of near-term development potential, as well as higher short-term oil prices that we base on EIA forecasts (in the long term we remain at US$70/bbl). Funding of identified growth projects and refinancing of the company’s complex capital structure are key management objectives for CY18.

Aneth: Material organic growth opportunity

Since the acquisition of Aneth in late 2017, management has identified numerous high IRR and quick payback development opportunities. While average development costs are low at a management estimated US$6.8/boe, investment remains contingent on restructuring ELK’s multi-layered debt structure. Refinancing aims include the simplification of capital structure, reduction in cost of debt and extension of debt amortisation leading to increased returns on equity and enhanced financial flexibility. We await confirmation of successful refinancing before fully de-risking Aneth’s growth potential, which we include risked at 75% in our update.

To read the entire report Please click on the pdf File Below: