- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tractor Supply's (TSCO) Strategies To Drive Earnings In Q4

We expect Tractor Supply Company (NASDAQ:TSCO) to beat expectations when it reports fourth-quarter 2017 results on Jan 31. The company delivered positive earnings surprise of 5.9% in the last reported quarter.

Further, the company has posted positive surprise in two of the trailing four quarters, with an average beat of 1.6%. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The questions popping up in the investors minds’ is that whether Tractor Supply will be able to deliver a positive earnings surprise in the quarter to be reported.

The Zacks Consensus Estimate for the fourth quarter is pegged at 87 cents, reflecting a decline of 7.5% year over year. Moreover, earnings estimate for the current quarter has climbed in the last 30 days. Also, analysts polled by Zacks expect revenues of $1.95 billion, up about 1.6% from the year-ago quarter.

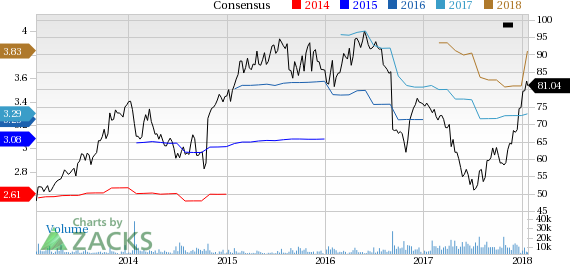

Tractor Supply has outperformed the industry in the past month, reflecting increased optimism on the stock ahead of the earnings release. The company’s shares improved 8.8% in the past month compared with the industry growth of 6%. Moreover, the stock has displayed a solid growth of 39.9% in the last three months mainly driven by its focus on store growth initiatives.

Factors at Play

Tractor Supply is well on track with its growth initiatives, which include expansion of store base and incorporation of technological advancements to induce traffic and drive the top line. It leverages an extensive network of stores to penetrate into target markets, which in turn, enables the company to generate healthy sales and gain market share. Meanwhile, the company remains on track with its target of opening about 100 Tractor Supply stores and 25 Petsense stores in 2017. It is also likely to reach its long-term domestic store growth target of 2,500 stores.

Additionally, the company’s efforts to integrate physical and digital operations through its Tractor One initiative, is reaping returns for stockholders. The company is poised to gain particularly from its Buy Online Pick Up in Store program while it continues to expand the Neighbor’s Club customer rewards program.

Furthermore, its expansion into the flourishing pet specialty business with the acquisition of Petsense is a welcome move. This buyout opens up doors to tap the roughly $60 billion pet market.

Markedly, these efforts have been driving the company’s top- and bottom-line growth for more than two years and are likely to aid future results as well.

What the Zacks Model Unveils?

Our proven model shows that Tractor Supply is likely to beat earnings estimates because it has the right combination of two key components. A stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen.

Tractor Supply has an Earnings ESP of +0.92% as the Most Accurate Estimate of 88 cents is pegged above the Zacks Consensus Estimate of 87 cents. This along with the company’s Zacks Rank #2 makes us reasonably confident of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat:

Hibbett Sports Inc. (NASDAQ:HIBB) has an Earnings ESP of +3.01% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Aaron’s Inc. (NYSE:AAN) has an Earnings ESP of +1.66% and a Zacks Rank #2.

American Eagle Outfitters Inc. (NYSE:AEO) has an Earnings ESP of +0.07% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Aaron's, Inc. (AAN): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Tractor Supply Company (TSCO): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.