- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TopBuild (BLD) Rides On Acquisitions, Higher Selling Prices

TopBuild Corp.’s (NYSE:BLD) business has been benefiting from strategic acquisitions, strong selling prices and strength in the Insulation Installation business. Also, solid prospects across the business and operational efficiencies are adding to the bliss.

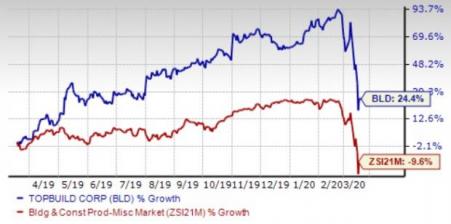

Shares of the company have rallied 24.4% in the past year against the Zacks Building Products - Miscellaneous industry’s 9.6% fall.

Strengthened U.S. housing market prospects will help this Zacks Rank #2 (Buy) company to post solid results going forward. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Its solid earnings surprise history might have supported the strong price movement. Earnings surpassed the Zacks Consensus Estimate in 13 of the trailing 14 quarters. Let’s delve deeper into the factors supporting the company’s solid price movement and prospects.

Strong Growth & View: TopBuild’s shares have rallied high on the back of solid earnings and revenue growth over the last few quarters. Not only the top and bottom lines surpassed analysts’ expectations, but also improved year over year. In fact, 2019 revenues and earnings grew 10.1% and 7.2%, respectively, from a year ago. Adjusted operating margin improved 140 bps and adjusted EBITDA margin grew 180 bps from 2018.

Backed by solid fundamentals for the residential new construction market, continued strength in the commercial business, solid backlog and greenfield expansion opportunities, TopBuild expects 2020 sales within $2,765-$2,835 million.

Adjusted EBITDA is projected between $387 million and $412 million, indicating a significant increase from $359.1 million registered in 2019. Housing starts in 2020 is likely to be within 1.30-1.34 million.

Strategic Acquisitions & Buyback Programs: TopBuild has been undertaking a few initiatives to drive growth. These initiatives include carrying out acquisitions and divestures, as well as driving shareholder value through repurchase programs.

In February 2020, the company announced that it has added Hunter Insulation — an 80-year old residential insulation company based in Long Island, NY — and Cooper Glass Co, LLC — a commercial glass company serving the Memphis market — to its portfolio.

Also, in July 2019, it acquired Burbank, CA-based Viking Insulation — an insulation installation company. The company expects solid improvement in net sales and earnings, and plans to invest more in these companies going forward.

In addition to acquisitions, it plans to close some low-margin businesses to focus on core areas in a bid to accelerate growth and improve shareholder value. In 2019, TopBuild bought back 1.3 million shares for $111 million through the repurchase program. Also, it announced an additional $200 million shares under the 2019 repurchase program on Feb 22, 2020.

Installation Business Prospects Look Good: The Installation unit — which accounted for nearly 73% of total 2019 net sales — installs insulation and other building products through the TruTeam contractor services business. In 2019, the segment recorded 13.4% net sales growth, with 150-bps improvement in adjusted operating margin. The upside was primarily driven by increase of 3.8% in selling prices and 2.5% in sales volume, operational efficiencies, along with 7.1% acquisition synergies, partially offset by higher material costs.

Notably, the segment’s adjusted operating margin has improved 820 bps since 2015.

Higher Return on Equity & Solid VGM Score: TopBuild’s trailing 12-month return on equity (ROE) is indicative of growth potential. ROE in the trailing 12 months is 16.6% compared with the industry’s 11.5%, reflecting the company’s efficient usage of its shareholders’ funds.

TopBuild has a solid VGM Score of A. Our VGM Score identifies stocks that have the most attractive value, growth and momentum characteristics. In fact, our research shows that stocks with VGM Scores of A or B when combined with a Zacks Rank #1 or 2 make solid investment choices.

Moreover, the company — which shares space with Installed Building Products, Inc. (NYSE:IBP) , Arcosa, Inc. (NYSE:ACA) and Armstrong World Industries, Inc. (NYSE:AWI) in the industry — is a great pick in terms of growth investment, supported by a Growth Score of A.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Armstrong World Industries, Inc. (AWI): Free Stock Analysis Report

Installed Building Products, Inc. (IBP): Free Stock Analysis Report

TopBuild Corp. (BLD): Free Stock Analysis Report

Arcosa, Inc. (ACA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.