- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Trade Ideas For The Week Of September 21, 2015

Here are the Rest of the Top 10:

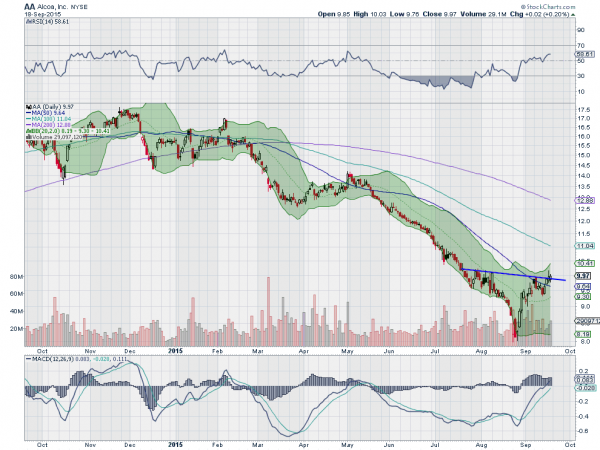

Alcoa (NYSE:AA)

Alcoa has had a long down trend since topping at the end of 2014. The market low in August may have represented as significant bottom for the stock though as it has risen since. Last week saw the price push through to a higher high, and cross the neckline or an Inverse head and Shoulders pattern. The RSI is rising and on the edge of a push into the bullish zone for the first time since the beginning of May. The MACD crossed at the market bottom and has been rising ever since.

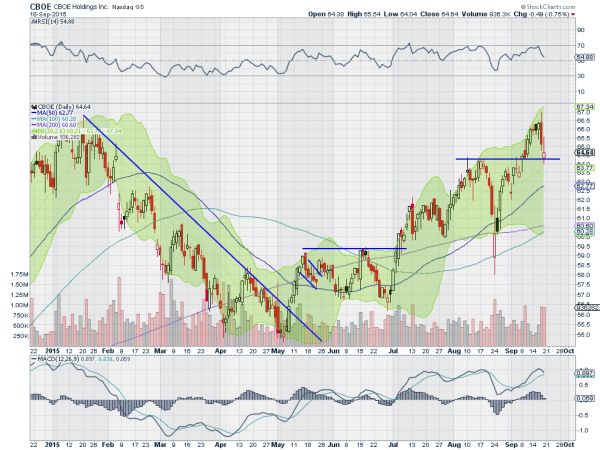

CBOE Holdings Inc (NASDAQ:CBOE)

CBOE, has been stair stepping higher since making a bottom in May. it has been a trade idea a couple of time along the way. Last week it rose to the prior high from January and then pushed lower. It held Friday at what was prior resistance, now becoming support. The RSI is in the bullish zone, but moving lower. The MACD is curling down towards a bearish cross. This is at a place where it could reverse back higher or continue lower, each with good reward to risk. Let it tell which path to follow.

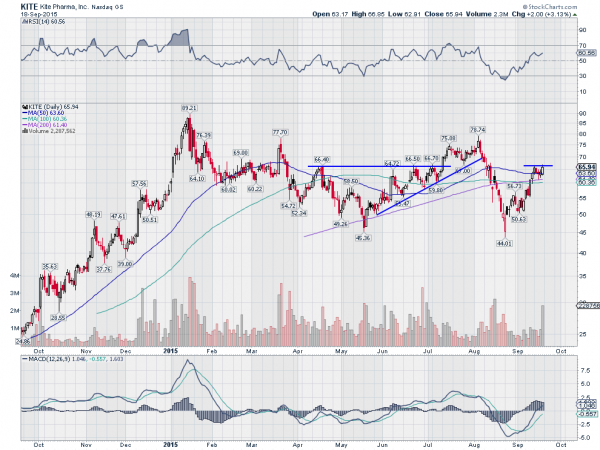

Kite Pharma (NASDAQ:KITE)

Kite Pharma had established a rising trend support against flat resistance through July. This led to a break to the upside that was short lived. August saw the price pullback and make a double bottom before starting back higher. Now it has consolidated at that prior resistance for a few days after a rise. The RSI is pushing higher and the MACD is rising, both supporting a break to the upside.

Pandora Media Inc (NYSE:P)

Pandora Media went through a long pullback in a rounded bottom. This rose to fail at 19 and then made a ‘V’ that also failed. A Adam and Eve bottom. Now after a minor pullback it has pushed up through resistance and may be ready for significant upside. The RSI is bullish and rising and the MACD is crossed up. The Bollinger Bands® are also opening to the upside.

Palo Alto Networks Inc (NYSE:PANW)

Palo Alto Networks was a stock market darling over the spring and early summer. It made a top in July and pulled back, nearly retracing the entire move up when the market bottomed in August. Since then it has moved back higher and is in a minor consolidation. The RSI is in the bullish zone and the MACD rising, both supporting continued upward price action.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the last week of summer and out of expiration week sees the equity markets looking weak again.

Elsewhere look for gold to continue the bounce in its downtrend while crude oil slows consolidates with a short term bias lower. The US dollar index looks better to the downside in consolidation while US Treasuries may reverse higher in the downtrend. The Shanghai Composite looks to continue consolidation in the downtrend and Emerging Markets are biased to the downside after their bounce.

Volatility looks to remain above normal levels in its drift down with a chance of a renewed push higher. This would keep the bias flat to lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and QQQ. Their charts agree with a downward bias although all are in consolidation ranges, no man’s land. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.