- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Trade Ideas For Week Of January 11, 2016: D, EW, GNC, PPG, UNH

Here are the Rest of the Top 10:

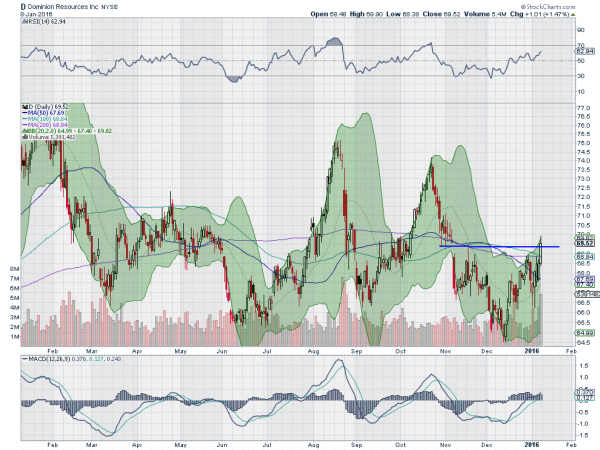

Dominion Resources (N:D)

Dominion Resources is the first utility to make the Top 10 in a long time. Many have broken out, but this one is rising and at a critical point for a trade. It is filling the gap from November and breaking the 200 day SMA. The RSI is rising and in the bullish zone while the MACD is also rising. Look for a break above the gap level to participate.

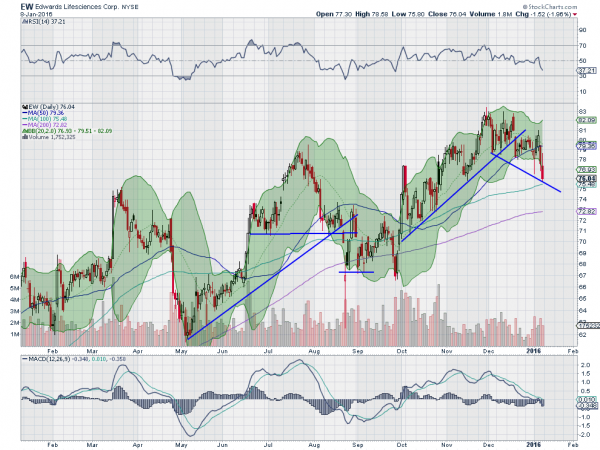

Edwards Lifesciences (N:EW)

Edwards Lifesciences made a top in late November and has been pulling back since. Friday it accelerated lower and that move brought the RSI down into the bearish zone. The MACD continues to fall as well. With the 100 day SMA just below, look for a break below it to follow to the downside.

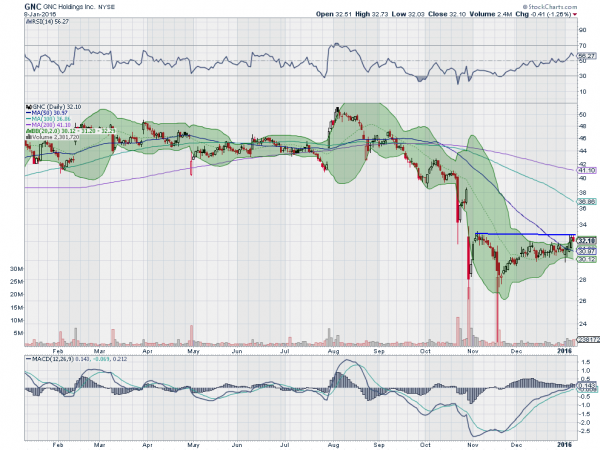

GNC (N:GNC)

GNC made a top in August as it pushed out of consolidation, but then failed and trended lower. There was a strong selling spike down in October upon release of their earnings report and then again in November on news of a Federal Enforcement Action. But since then it has consolidated and is now slowly turning higher. Friday brought it to the November high with the Bollinger Bands® opening. The RSI is rising and on the edge of the bullish zone with the MACD also rising. Look for a push over the November high to participate to the upside.

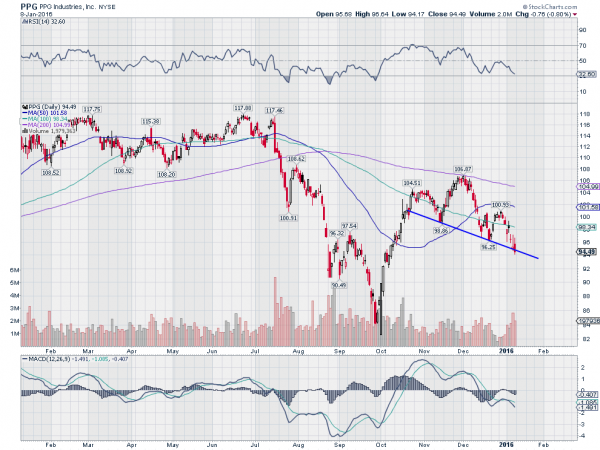

PPG Industries (N:PPG)

PPG Industries had a solid bounce off of the bottom made at the start of October. But that move sputtered as it pushed over 100 and it has now been falling against trend support. The RSI is falling and bearish and the MACD is falling too. Look for a push under support to accelerate the move lower.

UnitedHealth Group (N:UNH)

UnitedHealth Group has built a yearlong consolidation over support after a strong move higher. Heading into the week it is testing that support again, with the RSI in the bearish zone and the MACD falling. Look for a break of support to enter on the short side. The consolidation has the look of a rounding top and that could mean there is major downside opportunity.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, the worst first week of the New Year ever. Now heading into January options expiration there really does not look to be any relief in sight for the equity markets.

Elsewhere look for gold to continue the bounce higher in its downtrend while crude oil burns lower. The US dollar index looks to continue consolidation at its highs while US Treasuries are biased higher in consolidation. The Shanghai Composite and Emerging Markets are biased to the downside and looking really ugly.

Volatility looks to remain elevated keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts also point lower with perhaps a pause or oversold bounce in the short run, but with their intermediate term charts moving decidedly more bearish. The one possible exception is the QQQ which remains somewhat above the August lows. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.