- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Value Stocks To Buy For March 16th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, March 16th:

Banco Macro S.A. (BMA): This company that provides various banking products and services to individuals and corporate customers has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 10.1% over the last 60 days.

Macro Bank Inc. Price and Consensus

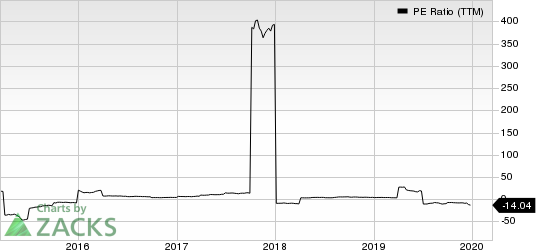

Banco Macro has a price-to-earnings ratio (P/E) of 2.25 compared with 8.00 for the industry. The company possesses a Value Score of A.

Macro Bank Inc. PE Ratio (TTM)

AutoNation (NYSE:AN), Inc. (AN): This automotive retailer has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.7% over the last 60 days.

AutoNation, Inc. Price and Consensus

AutoNation has a price-to-earnings ratio (P/E) of 6.87 compared with 7.60 for the industry. The company possesses a Value Score of B.

AutoNation, Inc. PE Ratio (TTM)

Renewable Energy Group, Inc. (REGI): This provider of low carbon transportation fuels has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 62.3% over the last 60 days.

Renewable Energy Group, Inc. Price and Consensus

Renewable Energy has a price-to-earnings ratio (P/E) of 5.75 compared with 9.60 for the industry. The company possesses a Value Score of A.

Renewable Energy Group, Inc. PE Ratio (TTM)

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Find more top income stocks with some of our great premium screens.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Renewable Energy Group, Inc. (REGI): Free Stock Analysis Report

Macro Bank Inc. (BMA): Free Stock Analysis Report

AutoNation, Inc. (AN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.